Analyst Backs Spot Bitcoin ETFs To Surpass Gold ETFs In Cumulative Net Inflows

Market analyst and President of the ETF Store Nate Geraci has backed the US-based spot Bitcoin ETFs to overtake the Gold ETFs in terms of cumulative net flows. This projection comes amidst a staggering performance by these Bitcoin ETFs in the past few days where they have attracted over $2 billion in weekly netflows. Related Reading: Bitcoin Breaking Out Of 7-Month Accumulation Channel: Expert Predicts Further Upside Spot Bitcoin ETFs To Surpass Gold ETF In 2 Years, Analyst Says The spot Bitcoin ETFs rattled the global financial markets this week recording net inflows of $2.13 billion according to data from SoSoValue. This massive influx of investments occurred as Bitcoin surged by 9.23%, approaching a critical resistance zone at the $70,000 price mark. Amidst this market euphoria, Nate Geraci has predicted the spot Bitcoin ETFs to record a higher cumulative total netflows than the Gold ETFs in the next two years. This forecast is largely unsurprising considering the exponential growth of these Bitcoin ETFs since their launch on January 11. For context, the Gold ETFs currently boast of combined net inflows of around $55 billion in comparison to $20.66 billion aggregate net inflows in the spot Bitcoin ETFs market. However, the Bitcoin ETFs have been trading for barely a year compared to the Gold ETFs which have been around for over 20 years. Furthermore, Bloomberg analyst Eric Balchunas recently highlighted that spot Bitcoin ETFs have amassed over $65 billion in total net assets, a milestone that took Gold ETFs nearly five years to achieve. This figure is also over 25% of the total assets under management in the global Gold ETF market. In addition, Geraci’s theory is further strengthened by the few 11 spot Bitcoin ETFs currently trading compared to the almost 5000 Gold ETFs on the global financial market. Therefore, these Bitcoin ETFs may actually be poised to overtake their Gold counterparts, especially considering the upcoming crypto market bull run and current adoption levels of digital assets. Related Reading: Bitcoin Price To $95,000? Here’s What Needs To Happen First Bitcoin Set For Price Recorrection Amidst Market Surge In other news, crypto analyst Ali Martinez has shared that Bitcoin may soon experience a “short-term dip” following its recent price rally. As earlier stated, the crypto market leader gained by over 8% moving from around $63,000 to nearly breaking above $69,000. While the BTC market is currently bullish, Martinez states that the TD sequential is currently indicating a sell signal on the 4-hour chart which is strengthened by a bearish divergence on the Relative Strength Index (RSI). If Bitcoin’s price were to decline, investors would turn their attention to the $60,000 price zone at which lies its next support level. Albeit a strong selling pressure may cause the premier cryptocurrency to trade as low as $55,000. At the time of writing, Bitcoin continues to trade at $68,428 with a 0.98% gain in the last day. Featured image from Forbes, chart from Tradingview

Market analyst and President of the ETF Store Nate Geraci has backed the US-based spot Bitcoin ETFs to overtake the Gold ETFs in terms of cumulative net flows. This projection comes amidst a staggering performance by these Bitcoin ETFs in the past few days where they have attracted over $2 billion in weekly netflows.

Spot Bitcoin ETFs To Surpass Gold ETF In 2 Years, Analyst Says

The spot Bitcoin ETFs rattled the global financial markets this week recording net inflows of $2.13 billion according to data from SoSoValue. This massive influx of investments occurred as Bitcoin surged by 9.23%, approaching a critical resistance zone at the $70,000 price mark.

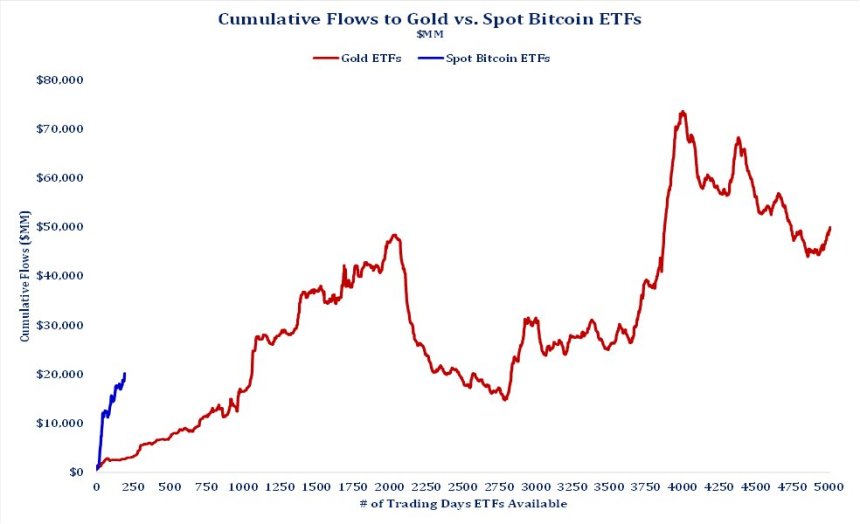

Amidst this market euphoria, Nate Geraci has predicted the spot Bitcoin ETFs to record a higher cumulative total netflows than the Gold ETFs in the next two years. This forecast is largely unsurprising considering the exponential growth of these Bitcoin ETFs since their launch on January 11.

For context, the Gold ETFs currently boast of combined net inflows of around $55 billion in comparison to $20.66 billion aggregate net inflows in the spot Bitcoin ETFs market. However, the Bitcoin ETFs have been trading for barely a year compared to the Gold ETFs which have been around for over 20 years.

Furthermore, Bloomberg analyst Eric Balchunas recently highlighted that spot Bitcoin ETFs have amassed over $65 billion in total net assets, a milestone that took Gold ETFs nearly five years to achieve. This figure is also over 25% of the total assets under management in the global Gold ETF market.

In addition, Geraci’s theory is further strengthened by the few 11 spot Bitcoin ETFs currently trading compared to the almost 5000 Gold ETFs on the global financial market. Therefore, these Bitcoin ETFs may actually be poised to overtake their Gold counterparts, especially considering the upcoming crypto market bull run and current adoption levels of digital assets.

Bitcoin Set For Price Recorrection Amidst Market Surge

In other news, crypto analyst Ali Martinez has shared that Bitcoin may soon experience a “short-term dip” following its recent price rally. As earlier stated, the crypto market leader gained by over 8% moving from around $63,000 to nearly breaking above $69,000.

While the BTC market is currently bullish, Martinez states that the TD sequential is currently indicating a sell signal on the 4-hour chart which is strengthened by a bearish divergence on the Relative Strength Index (RSI). If Bitcoin’s price were to decline, investors would turn their attention to the $60,000 price zone at which lies its next support level. Albeit a strong selling pressure may cause the premier cryptocurrency to trade as low as $55,000.

At the time of writing, Bitcoin continues to trade at $68,428 with a 0.98% gain in the last day.

What's Your Reaction?

.gif)