Aptos (APT) Inks 25% Gain After Hitting A New Milestone – Details

Aptos (APT) goes against the market’s general downward momentum. According to CoinGecko, the token is up more than 25% since last week, a good sign despite the broader market dipping by 3% in the past 24 hours. Related Reading: Bitcoin SV Makes A Surprise Move With 10% Uptick – Details The network is breaking new ground today. The Aptos main X account recently announced that their platform achieved a new high in transactions per second (TPS), a metric that is based on how fast the network can process transactions without any downtime. This win shows that Aptos can punch above its weight, competing with big players like Solana and Ethereum in the highly-stacked crypto market. Achievement Unlocked: High TPS Creates New Hype For Aptos According to Aptos, the network broke the 4,000 real-time transactions per second threshold, having a peak of nearly 12,500 TPS yesterday. The network is flexing its muscle as this contributed greatly to APT’s current price range. ????@Aptos facilitated ~50x more daily txs than @ethereum (L1) and ~10x more than @base (L2). pic.twitter.com/JayZAPlluD — Token Terminal (@tokenterminal) August 14, 2024 The achievement has been applauded by users on the platform with replies to the post ranging from “amazing” to “Let’s break all the (expletive) records.” The hype generated by this achievement was further boosted as Token Terminal, a blockchain analytics platform, stated that Aptos processed more transactions than both Ethereum and Base combined. Related Reading: HODLing Resurgence? 374,000 Bitcoin Transfer Ignites Crypto Recovery “@Aptos facilitated ~50x more daily txs than @ethereum (L1) and ~10x more than @base (L2)” said Token Terminal, showing that Aptos has the infrastructure and the network capacity to go against the big players of the crypto community. Aptos is also repeatedly compared to Solana, a direct competitor to Aptos, with reevolution.apt stating that Aptos will flip Solana in the future. This bullishness on the platform can be seen on-chain as almost all metrics have gained significant upticks since then. Rejection On This Level Might Threaten APT Gains As of writing, APT has been rejected on a crucial price ceiling of $6.8, continuing the downward trend it started yesterday. With this in mind, the token might see more pain in the short term, possibly moving back to more sustainable levels of momentum. However, APT poses a huge threat to other layer-1s in the market. Boasting high throughput with no downtime is a game changer to the overall user experience on the platform. But the token’s current position is still threatened by the overall market momentum which, as it currently stands, is bearish as the market continues to slip under the pressure of the bears. In the short term, investors and traders should remain cautious while watching the general market movement as any indication that the dip will continue in the next couple of days will hurt profits. However, playing the long game will benefit them as the token’s current position opens up $7.6 once conditions become bearable. Featured image from NullTX, chart from TradingView

Aptos (APT) goes against the market’s general downward momentum. According to CoinGecko, the token is up more than 25% since last week, a good sign despite the broader market dipping by 3% in the past 24 hours.

The network is breaking new ground today. The Aptos main X account recently announced that their platform achieved a new high in transactions per second (TPS), a metric that is based on how fast the network can process transactions without any downtime. This win shows that Aptos can punch above its weight, competing with big players like Solana and Ethereum in the highly-stacked crypto market.

Achievement Unlocked: High TPS Creates New Hype For Aptos

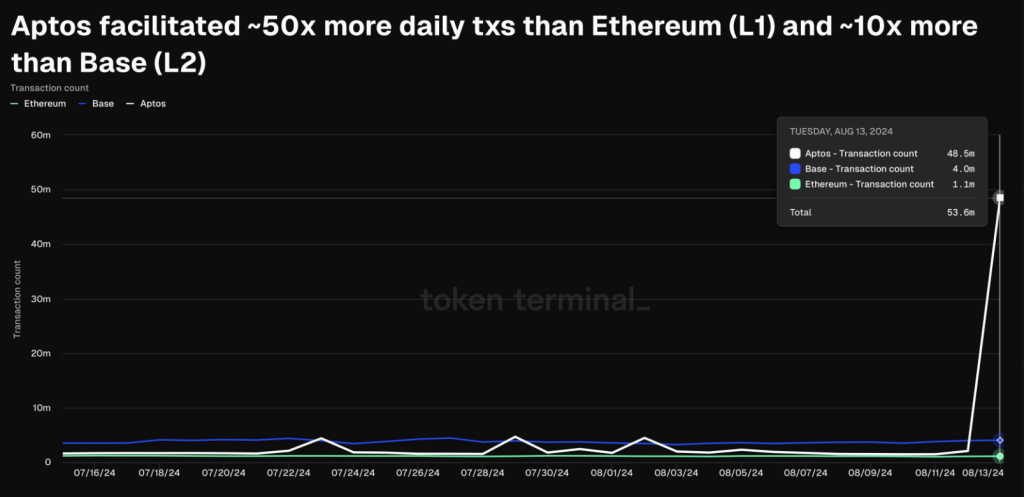

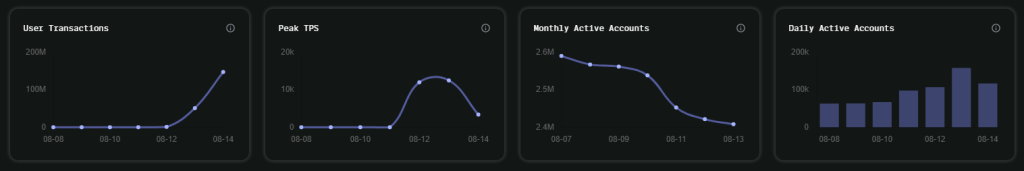

According to Aptos, the network broke the 4,000 real-time transactions per second threshold, having a peak of nearly 12,500 TPS yesterday. The network is flexing its muscle as this contributed greatly to APT’s current price range.

@Aptos facilitated ~50x more daily txs than @ethereum (L1) and ~10x more than @base (L2). pic.twitter.com/JayZAPlluD

— Token Terminal (@tokenterminal) August 14, 2024

The achievement has been applauded by users on the platform with replies to the post ranging from “amazing” to “Let’s break all the (expletive) records.” The hype generated by this achievement was further boosted as Token Terminal, a blockchain analytics platform, stated that Aptos processed more transactions than both Ethereum and Base combined.

“@Aptos facilitated ~50x more daily txs than @ethereum (L1) and ~10x more than @base (L2)” said Token Terminal, showing that Aptos has the infrastructure and the network capacity to go against the big players of the crypto community.

Aptos is also repeatedly compared to Solana, a direct competitor to Aptos, with reevolution.apt stating that Aptos will flip Solana in the future.

This bullishness on the platform can be seen on-chain as almost all metrics have gained significant upticks since then.

Rejection On This Level Might Threaten APT Gains

As of writing, APT has been rejected on a crucial price ceiling of $6.8, continuing the downward trend it started yesterday. With this in mind, the token might see more pain in the short term, possibly moving back to more sustainable levels of momentum.

However, APT poses a huge threat to other layer-1s in the market. Boasting high throughput with no downtime is a game changer to the overall user experience on the platform.

But the token’s current position is still threatened by the overall market momentum which, as it currently stands, is bearish as the market continues to slip under the pressure of the bears.

In the short term, investors and traders should remain cautious while watching the general market movement as any indication that the dip will continue in the next couple of days will hurt profits. However, playing the long game will benefit them as the token’s current position opens up $7.6 once conditions become bearable.

Featured image from NullTX, chart from TradingView

What's Your Reaction?

.jpeg)

.gif)