Bitcoin Breaks Past $67,000 After Spot ETFs See Highest Capital Inflows In Months

As the broader crypto market starts to rebound, Bitcoin is once more in the forefront and crosses the $67,000 barrier. Bitcoin is trading roughly $67,150 as of October 16, a good 4% increase in just 24 hours. Given that it represents the crypto’s highest price point since late July, this spike is notable. Related Reading: Neiro Coin Blows Up 4,608%—Can It Sustain The Momentum? The recent rally saw spot Bitcoin exchange-traded funds (ETFs) garner the largest single-day inflow of capital in over four months. Bitcoin jumped to $67,820 before stabilizing to the $67,000 level at the time of writing. It appears momentum is gaining, with growing attention from investors in this space. Key Factors Driving Bitcoin’s Increase The response of the global market to recent updates from China is one of the key forces behind the increase of Bitcoin. The nation has been trying hard to resuscitate its economy, and its most recent stimulus announcement begs numerous questions about whether it is sufficient. Some speculators have switched their attention from Chinese stocks to cryptocurrencies like Bitcoin since economists feel China’s attempts to control deflation are failing. Bloomberg claims that this trend points to an increasing curiosity in Bitcoin as a safer investment. Another clear indication of good momentum are flows into spot Bitcoin ETFs. Following a little period of outflows, these ETFs showed a dramatic change on October 14, topping $253 million in capital inflows. This trend suggests that there may be less selling pressure on Bitcoin, so indicating fresh investor confidence. Impact Of US Election The approaching US presidential election is also driving Bitcoin’s surge. Prediction markets today reflect a change favoring Republican candidate Donald Trump, who is pro-crypto, over Democratic Vice President Kamala Harris. Based on Polymarket’s betting statistics, consumers think Trump has a 58% chance of winning, therefore clearly surpassing Harris. Given investors’ view of cryptocurrencies as a counterpoint to conventional financial systems, this political environment adds to Bitcoin’s appeal. The sentiment of the market on the elections can inspire more speculative crypto investments, so increasing the price of Bitcoin. Related Reading: Solana Blockchain On Fire, Registers 11% Growth In Just One Week Liquidations And Market Perception The abrupt price increase has also driven crypto liquidations above $300 million throughout the past 24 hours. Most of these were short-BTC, meaning many traders anticipated declining prices. Many see Bitcoin as a risk asset, so a significant increase in the US stock market could have helped to inspire a fresh “hunger” for it. Meanwhile, higher stock prices along with lower Federal Reserve funding rates can be encouraging market liquidity. When Bitcoin, eventually, displays seasonal strength during the fourth quarter, then it’s only a period when the trends related with these factors would play out in the next couple of weeks. Featured image from Homebuilding & Renovating, chart from TradingView

As the broader crypto market starts to rebound, Bitcoin is once more in the forefront and crosses the $67,000 barrier. Bitcoin is trading roughly $67,150 as of October 16, a good 4% increase in just 24 hours. Given that it represents the crypto’s highest price point since late July, this spike is notable.

The recent rally saw spot Bitcoin exchange-traded funds (ETFs) garner the largest single-day inflow of capital in over four months. Bitcoin jumped to $67,820 before stabilizing to the $67,000 level at the time of writing. It appears momentum is gaining, with growing attention from investors in this space.

Key Factors Driving Bitcoin’s Increase

The response of the global market to recent updates from China is one of the key forces behind the increase of Bitcoin. The nation has been trying hard to resuscitate its economy, and its most recent stimulus announcement begs numerous questions about whether it is sufficient. Some speculators have switched their attention from Chinese stocks to cryptocurrencies like Bitcoin since economists feel China’s attempts to control deflation are failing.

Bloomberg claims that this trend points to an increasing curiosity in Bitcoin as a safer investment. Another clear indication of good momentum are flows into spot Bitcoin ETFs. Following a little period of outflows, these ETFs showed a dramatic change on October 14, topping $253 million in capital inflows. This trend suggests that there may be less selling pressure on Bitcoin, so indicating fresh investor confidence.

Impact Of US Election

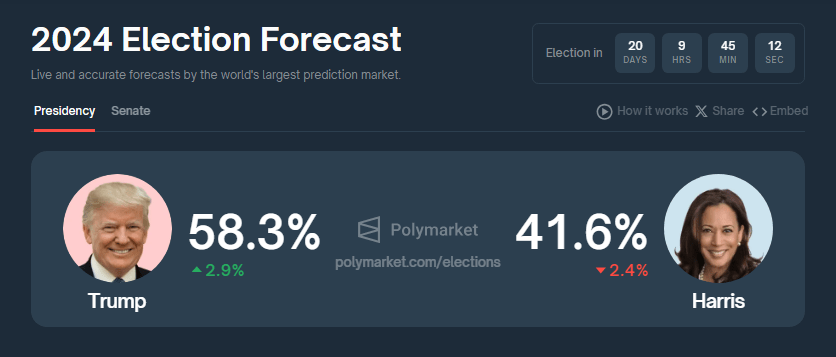

The approaching US presidential election is also driving Bitcoin’s surge. Prediction markets today reflect a change favoring Republican candidate Donald Trump, who is pro-crypto, over Democratic Vice President Kamala Harris. Based on Polymarket’s betting statistics, consumers think Trump has a 58% chance of winning, therefore clearly surpassing Harris.

Given investors’ view of cryptocurrencies as a counterpoint to conventional financial systems, this political environment adds to Bitcoin’s appeal. The sentiment of the market on the elections can inspire more speculative crypto investments, so increasing the price of Bitcoin.

Liquidations And Market Perception

Liquidations And Market Perception

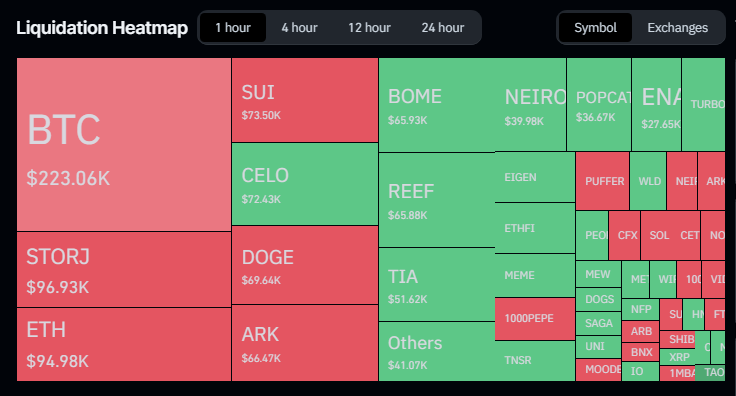

The abrupt price increase has also driven crypto liquidations above $300 million throughout the past 24 hours. Most of these were short-BTC, meaning many traders anticipated declining prices. Many see Bitcoin as a risk asset, so a significant increase in the US stock market could have helped to inspire a fresh “hunger” for it.

Meanwhile, higher stock prices along with lower Federal Reserve funding rates can be encouraging market liquidity. When Bitcoin, eventually, displays seasonal strength during the fourth quarter, then it’s only a period when the trends related with these factors would play out in the next couple of weeks.

Featured image from Homebuilding & Renovating, chart from TradingView

What's Your Reaction?

.gif)