Bitcoin Stock To Flow Model Shows Price Is Ready For Next Phase Transition Above $100,000

Bitcoin is on its way to retesting the $69,000 price level again in the early hours of Monday, October 28, as the bulls look to start the week on a positive note. A notable break above $69,000 would set the stage for a sustained rally in the coming months. Speaking of sustained rally, the Bitcoin Stock-to-Flow model is pointing to an interesting trend in the long-term outlook for Bitcoin. Particularly, crypto analyst Plan B made reference to the Stock-to-Flow model to suggest that BTC is ready for the next phase transition. BTC Is Ready For Next Phase Transition The Bitcoin Stock-to-Flow (S2F) model is drawing attention as it signals that Bitcoin may be gearing up for a new phase transition that would solidify its price above $100,000. The S2F model, originally developed for commodities like gold and silver, measures an asset’s existing supply against the rate of new units entering the market. In the case of BTC, the S2F model calculates scarcity by taking its fixed supply of 21 million BTC into account, along with the block reward halvings that reduce new supply every four years. Related Reading: Dogecoin Price Flashes Bullish Pennant On Daily Heikin Ashi Chart, What This Means Each halving event decreases the issuance rate, creating an increasing scarcity that the model correlates with price growth. According to the S2F chart shared by Plan B, these halvings have led to price increases in the months after, with the S2F model accurately forecasting Bitcoin’s transitions into new price levels. Bitcoin last halved in April 2024, resulting in the block reward slashing from 6.25 BTC to 3.125 BTC. According to the S2F chart, past Bitcoin halvings have always started the price transition into a new phase. The 2020 halving, for example, kickstarted the transition into a new phase above $10,000 that culminated in BTC reaching the previous all-time high of around $66,000. Now that the April 2024 halving is six months behind us, the effects of the halving are starting to be factored into the supply and demand of Bitcoin. As such, Bitcoin is looking prime for a phase transition above $100,000. What Does This Mean For Bitcoin Price? As past phase transitions have played out, a phase transition above $100,000 would solidify the Bitcoin price above this level. With the $100,000 price level now serving as a price floor, this would give the Bitcoin price the support to keep increasing in the months after. Related Reading: Dogecoin Price To $24? Analyst Says No One Will Believe It Until It Happens Previous phase transitions have always led to a new peak before another halving. The anticipated peak for this phase is just below $1,000,000. If past trends hold true, the Bitcoin price could reach this impressive milestone ahead of the next halving, which is expected to take place in 2028. At the time of writing, Bitcoin is trading at $68,340. Featured image created with Dall.E, chart from Tradingview.com

Bitcoin is on its way to retesting the $69,000 price level again in the early hours of Monday, October 28, as the bulls look to start the week on a positive note. A notable break above $69,000 would set the stage for a sustained rally in the coming months.

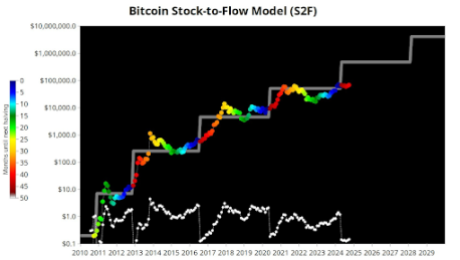

Speaking of sustained rally, the Bitcoin Stock-to-Flow model is pointing to an interesting trend in the long-term outlook for Bitcoin. Particularly, crypto analyst Plan B made reference to the Stock-to-Flow model to suggest that BTC is ready for the next phase transition.

BTC Is Ready For Next Phase Transition

The Bitcoin Stock-to-Flow (S2F) model is drawing attention as it signals that Bitcoin may be gearing up for a new phase transition that would solidify its price above $100,000. The S2F model, originally developed for commodities like gold and silver, measures an asset’s existing supply against the rate of new units entering the market. In the case of BTC, the S2F model calculates scarcity by taking its fixed supply of 21 million BTC into account, along with the block reward halvings that reduce new supply every four years.

Each halving event decreases the issuance rate, creating an increasing scarcity that the model correlates with price growth. According to the S2F chart shared by Plan B, these halvings have led to price increases in the months after, with the S2F model accurately forecasting Bitcoin’s transitions into new price levels.

Bitcoin last halved in April 2024, resulting in the block reward slashing from 6.25 BTC to 3.125 BTC. According to the S2F chart, past Bitcoin halvings have always started the price transition into a new phase. The 2020 halving, for example, kickstarted the transition into a new phase above $10,000 that culminated in BTC reaching the previous all-time high of around $66,000.

Now that the April 2024 halving is six months behind us, the effects of the halving are starting to be factored into the supply and demand of Bitcoin. As such, Bitcoin is looking prime for a phase transition above $100,000.

What Does This Mean For Bitcoin Price?

As past phase transitions have played out, a phase transition above $100,000 would solidify the Bitcoin price above this level. With the $100,000 price level now serving as a price floor, this would give the Bitcoin price the support to keep increasing in the months after.

Previous phase transitions have always led to a new peak before another halving. The anticipated peak for this phase is just below $1,000,000. If past trends hold true, the Bitcoin price could reach this impressive milestone ahead of the next halving, which is expected to take place in 2028.

At the time of writing, Bitcoin is trading at $68,340.

What's Your Reaction?

.gif)