Celsius Takes Legal Action Against Tether In $2.4 Bitcoin Collateral Controversy

Bankrupt crypto lender Celsius Network has initiated legal proceedings against Tether, the company behind the USDT stablecoin. The lawsuit, which was filed concerning a contract dispute dating back to 2022, alleges that Tether violated their agreement by unjustifiably liquidating 39,542.42 Bitcoins that were held as collateral for a loan issued in USDT. Celsius contends that Tether’s decision to sell the Bitcoin at that time was improper and a breach of the loan agreement. Celsius Files Lawsuit Against Tether Celsius Network’s disparity with Tether kicked off with a Bitcoin crash in 2022 and ultimately contributed to the crypto lender filing for bankruptcy in July 2022. The legal dispute centers around a revised agreement made in January 2022, which permitted Celsius to borrow USDT from Tether by securing the loan with collateral in Ether, Tether Gold, or Bitcoin. Related Reading: Cardano Eyes $0.3389: Can Bulls Sustain ADA Above This Critical Level? At the height of its borrowing, Celsius had secured nearly $2 billion in USDT from Tether, using tens of thousands of Bitcoins as collateral. As per the new agreement, Tether would be required to post a notice and wait for 10 hours if the value of the collateral were to fall below a specific threshold. However, Bitcoin’s crash in early 2022 meant the value of the Bitcoin collateral held by Tether tanked in tandem. As such, Tether required Celsius to post more collateral, a demand which it complied with by transferring 15,658.21 Bitcoin and another 2,228.01 Bitcoin of excess collateral for another loan. The complaint alleges that on June 13, 2022, Tether issued another demand for additional collateral. Contrary to the agreement’s requirement to wait for ten hours, Tether reportedly proceeded to liquidate the entire Bitcoin collateral without allowing Celsius the stipulated period to address the demand. “Tether forged ahead with an improper application of 39,542.42 Bitcoin—the entirety of collateral that Celsius had posted——using the pledged Bitcoin to cover its exposure in full, but destroying Celsius’s residual interest in the collateral,” the lawsuit read. Lawsuit Is Baseless, Tether Says Back then, the 39,542 BTC collateral for which Celsius is seeking a refund was worth around $800 million. However, the value of Bitcoin has grown since then, and the collateral is now worth more than $2 billion at today’s prices. In response, Tether addressed the lawsuit as baseless. The stablecoin company also confirmed Celsius Network’s $2.4 billion BTC claim, albeit while describing it as another “shameless litigation money grab” to which it will never succumb. Related Reading: Bitcoin Death Cross Threatens To Trigger Crash If Price Does Not Hold $62,000 Moreover, the lawsuit also demands the return of an additional 15,658.21 Bitcoins and 2,228.01 Bitcoins from a top-up transfer, bringing the total claimed value to over $3.5 billion at today’s Bitcoin prices. In other news, Tether’s USDT recently crossed a new milestone of a $115 billion market cap. Featured image from WSJ, chart from TradingView

Bankrupt crypto lender Celsius Network has initiated legal proceedings against Tether, the company behind the USDT stablecoin. The lawsuit, which was filed concerning a contract dispute dating back to 2022, alleges that Tether violated their agreement by unjustifiably liquidating 39,542.42 Bitcoins that were held as collateral for a loan issued in USDT. Celsius contends that Tether’s decision to sell the Bitcoin at that time was improper and a breach of the loan agreement.

Celsius Files Lawsuit Against Tether

Celsius Network’s disparity with Tether kicked off with a Bitcoin crash in 2022 and ultimately contributed to the crypto lender filing for bankruptcy in July 2022. The legal dispute centers around a revised agreement made in January 2022, which permitted Celsius to borrow USDT from Tether by securing the loan with collateral in Ether, Tether Gold, or Bitcoin.

At the height of its borrowing, Celsius had secured nearly $2 billion in USDT from Tether, using tens of thousands of Bitcoins as collateral.

As per the new agreement, Tether would be required to post a notice and wait for 10 hours if the value of the collateral were to fall below a specific threshold. However, Bitcoin’s crash in early 2022 meant the value of the Bitcoin collateral held by Tether tanked in tandem.

As such, Tether required Celsius to post more collateral, a demand which it complied with by transferring 15,658.21 Bitcoin and another 2,228.01 Bitcoin of excess collateral for another loan.

The complaint alleges that on June 13, 2022, Tether issued another demand for additional collateral. Contrary to the agreement’s requirement to wait for ten hours, Tether reportedly proceeded to liquidate the entire Bitcoin collateral without allowing Celsius the stipulated period to address the demand.

“Tether forged ahead with an improper application of 39,542.42 Bitcoin—the entirety of collateral that Celsius had posted——using the pledged Bitcoin to cover its exposure in full, but destroying Celsius’s residual interest in the collateral,” the lawsuit read.

Lawsuit Is Baseless, Tether Says

Back then, the 39,542 BTC collateral for which Celsius is seeking a refund was worth around $800 million. However, the value of Bitcoin has grown since then, and the collateral is now worth more than $2 billion at today’s prices.

In response, Tether addressed the lawsuit as baseless. The stablecoin company also confirmed Celsius Network’s $2.4 billion BTC claim, albeit while describing it as another “shameless litigation money grab” to which it will never succumb.

Moreover, the lawsuit also demands the return of an additional 15,658.21 Bitcoins and 2,228.01 Bitcoins from a top-up transfer, bringing the total claimed value to over $3.5 billion at today’s Bitcoin prices.

In other news, Tether’s USDT recently crossed a new milestone of a $115 billion market cap.

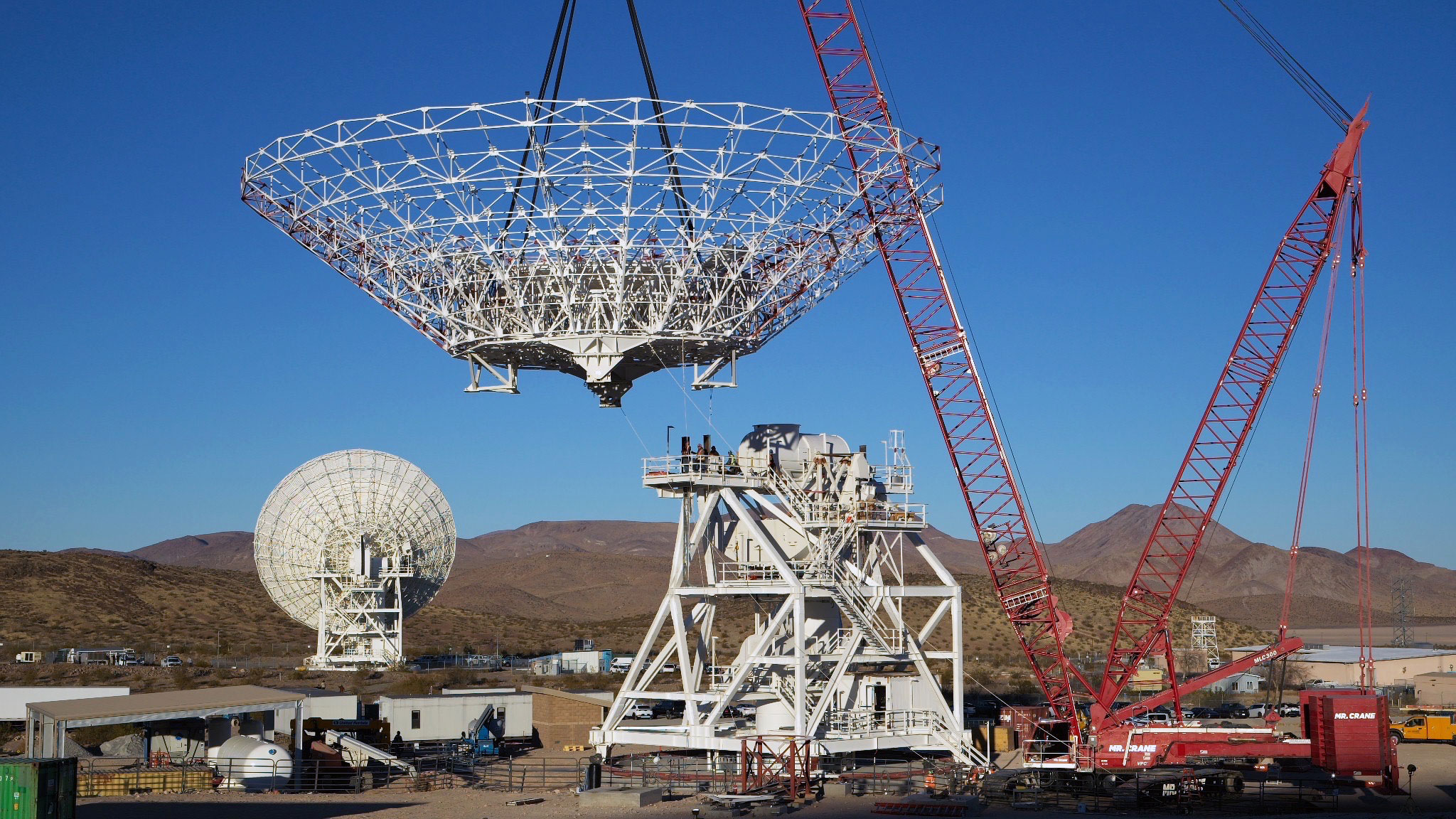

Featured image from WSJ, chart from TradingView

What's Your Reaction?

.gif)