Dogecoin Wins Over Major Demand Zone: Path To $0.15 Now Clear?

An analyst has pointed out how Dogecoin has reclaimed a major on-chain demand zone, which could open up the path to higher levels. Dogecoin May Not Have Much On-Chain Resistance At Upcoming Levels In a new post on X, analyst Ali Martinez has discussed about how DOGE has just overcome a major on-chain supply wall. On-chain supply ‘walls’ refer to price ranges that carry the cost basis of a significant amount of investors. Below is the chart from IntoTheBlock shared by the analyst, which shows how the different Dogecoin price ranges are currently looking in terms of this. In the graph, the size of the dot corresponds to the amount of DOGE that the addresses on the network last purchased between the corresponding price levels. The $0.108 to $0.111 range particularly stands out as it has a huge dot attached to it at the moment. Related Reading: Bitcoin Correlation With Gold Now At Highest Level Since March More specifically, the range contains the cost basis of around 62,270 addresses who bought a total of 36.08 billion tokens of the memecoin at levels situated inside it. To any investor, their cost basis or acquisition level is naturally special, due to which they can be prone to showing some kind of reaction when a retest of it takes place. Dogecoin retesting a range where only a few investors bought wouldn’t produce any significant reaction, but in the case of a major demand zone, like the $0.108 to $0.111 range mentioned earlier, holders may make enough simultaneous moves so as to cause fluctuations in the coin’s value. As for how exactly traders might react to a retest of their cost basis comes down to investor psychology. Retests of investors who were previously in loss can lead to a selling reaction, as these holders might fear the price will go down again in the future and thus, could decide to exit at their break-even, to at least get their investment back in full. Earlier, Dogecoin’s spot price had performed a retest of the $0.108 to $0.111 range from below, but it appears the resistance from these sellers wasn’t enough to hold back the meme coin as it has shot up above it with a sharp jump during the last 24 hours. From the chart, it’s apparent that unlike this latest range, DOGE has just surpassed, the levels ahead are relatively thin in terms of supply. “If DOGE holds this level, it could confirm a bullish breakout,” notes Martinez. “With no major supply walls in sight, the path to $0.150 looks clear!” Related Reading: Bitcoin Could Top At $400,000 Based On This Model, Analyst Says A potential run to this $0.150 mark from the current Dogecoin price would mean an increase of more than 31% for the memecoin. It now remains to be seen if the asset continues its rally in the coming days and whether it would be able to reach this level or not. DOGE Price At the time of writing, Dogecoin is floating around $0.114, up more than 9% over the last seven days. Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

An analyst has pointed out how Dogecoin has reclaimed a major on-chain demand zone, which could open up the path to higher levels.

Dogecoin May Not Have Much On-Chain Resistance At Upcoming Levels

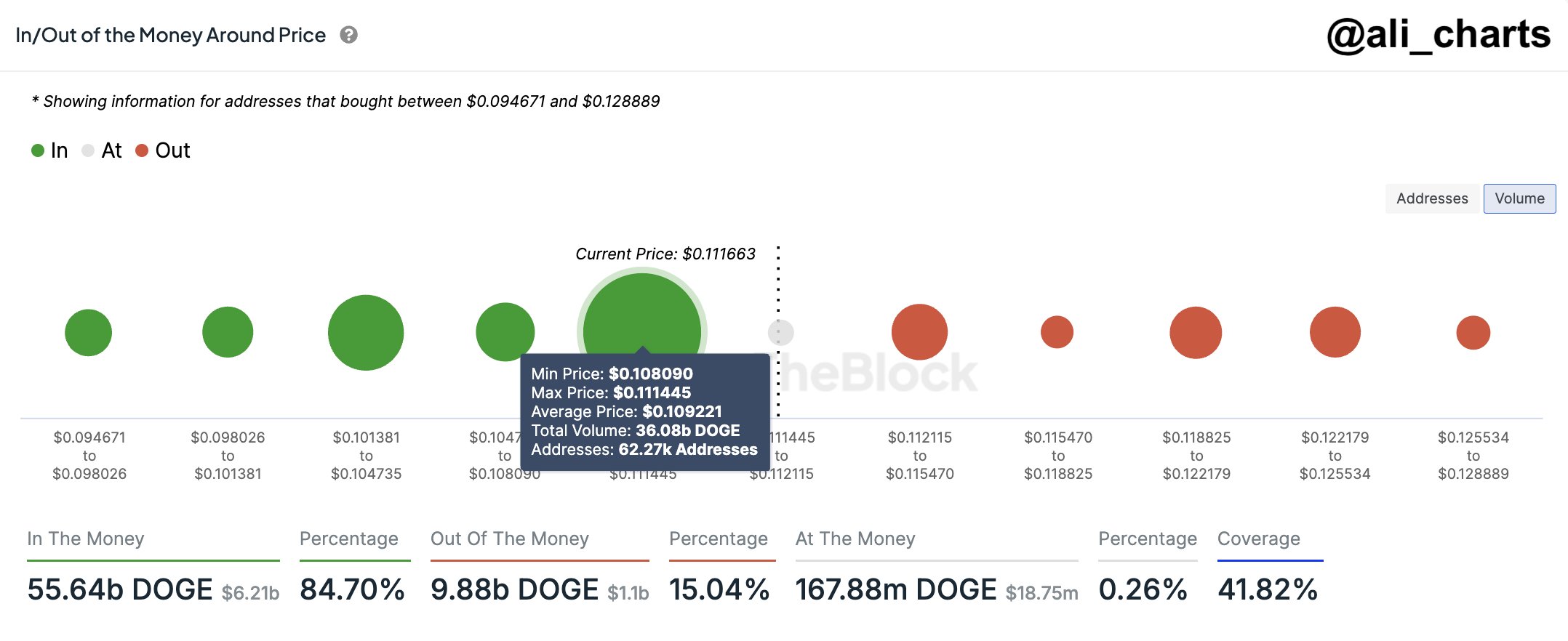

In a new post on X, analyst Ali Martinez has discussed about how DOGE has just overcome a major on-chain supply wall. On-chain supply ‘walls’ refer to price ranges that carry the cost basis of a significant amount of investors. Below is the chart from IntoTheBlock shared by the analyst, which shows how the different Dogecoin price ranges are currently looking in terms of this.

In the graph, the size of the dot corresponds to the amount of DOGE that the addresses on the network last purchased between the corresponding price levels. The $0.108 to $0.111 range particularly stands out as it has a huge dot attached to it at the moment.

More specifically, the range contains the cost basis of around 62,270 addresses who bought a total of 36.08 billion tokens of the memecoin at levels situated inside it. To any investor, their cost basis or acquisition level is naturally special, due to which they can be prone to showing some kind of reaction when a retest of it takes place.

Dogecoin retesting a range where only a few investors bought wouldn’t produce any significant reaction, but in the case of a major demand zone, like the $0.108 to $0.111 range mentioned earlier, holders may make enough simultaneous moves so as to cause fluctuations in the coin’s value.

As for how exactly traders might react to a retest of their cost basis comes down to investor psychology. Retests of investors who were previously in loss can lead to a selling reaction, as these holders might fear the price will go down again in the future and thus, could decide to exit at their break-even, to at least get their investment back in full.

Earlier, Dogecoin’s spot price had performed a retest of the $0.108 to $0.111 range from below, but it appears the resistance from these sellers wasn’t enough to hold back the meme coin as it has shot up above it with a sharp jump during the last 24 hours.

From the chart, it’s apparent that unlike this latest range, DOGE has just surpassed, the levels ahead are relatively thin in terms of supply. “If DOGE holds this level, it could confirm a bullish breakout,” notes Martinez. “With no major supply walls in sight, the path to $0.150 looks clear!”

A potential run to this $0.150 mark from the current Dogecoin price would mean an increase of more than 31% for the memecoin. It now remains to be seen if the asset continues its rally in the coming days and whether it would be able to reach this level or not.

DOGE Price

At the time of writing, Dogecoin is floating around $0.114, up more than 9% over the last seven days.

What's Your Reaction?

.jpeg)

.gif)