Ethereum Breaks Barriers, Targets $6K Amid Record ETF, TVL Activity

The increasing prominence of Ethereum is once again in the spotlight, as recent data indicates a substantial inflow of funds into Ether-based ETFs. These products have experienced a remarkable $133 million in net inflows over the course of seven days, indicating a significant increase in institutional interest and investor confidence. Related Reading: Hedera Breakthrough Moment: HBAR Rockets Over 800% – Details Ethereum isn’t just optimistic about exchange-traded funds (ETFs). Analysts are making big price predictions for the cryptocurrency right now. This is because its network is being used more and more in decentralized finance (DeFi) and technical signs are showing that it will continue to rise. On December 3, the total net inflow of Ethereum spot ETFs was $133 million, and net inflows continued for 7 consecutive days. The net inflow of Fidelity ETF FETH was $73.7239 million, and the net inflow of BlackRock ETF ETHA was $65.2929 million. https://t.co/Tvs2oCSxTg pic.twitter.com/HOPyOqmXGU — Wu Blockchain (@WuBlockchain) December 4, 2024 Institutional Confidence And Strong ETF Inflows A lot of people are interested in the Ethereum spot ETFs. Over $714 million has come into the top altcoin in the last week, showing that both institutional and individual buyers are becoming more interested in it. The ETHA ETF from BlackRock and the FETH ETF from Fidelity are leading the charge. Together, they have brought in about $140 million. The support of major financial institutions is boosting activity and demonstrating that Ethereum is becoming popular in the conventional finance sector. This flood of capital demonstrates how Ethereum may unite centralized and decentralized financial systems. Analysts Anticipate Mid-Term Target Of $6,000 For Ethereum According to market experts, the level of support for Ethereum stands at $3,300. This is a safe place for investors to start because it strikes a good balance between risk and return. Analysts propose a mid-term price target of $6,000 in case Ethereum continues its ascent. Some analysts even anticipate a long-term price of $10,000. If #Ethereum $ETH experiences a pullback, keep an eye on the $3,300 support level — a potential buying opportunity. Our mid-term target remains $6,000, with a long-term outlook of $10,000! https://t.co/mQQOjrKBFM pic.twitter.com/OEvDIV0ZpD — Ali (@ali_charts) December 4, 2024 Meanwhile, CoinCodex predicts that the price of Ethereum will have gone up by 6.17 percent to $4,052.34 by January 4, 2025. With an Extreme Greed number of 78 on the Fear & Greed Index and other technical indicators, it’s clear that people are planning to buy. Extreme confidence in the market suggests significant growth potential, but it is still important to take into account the inherent volatility of cryptocurrency investments. In the past 7 days, #Etherum‘s TVL increased by $4.81B, #Base‘s TVL increased by $302.02M, and #Hyperliquid‘s TVL increased by $290.21M. Funds have flowed into #Ethereum, #Base, and #Hyperliquid. pic.twitter.com/YDZOGU0Esc — Lookonchain (@lookonchain) December 2, 2024 Related Reading: No Sweat! Dogecoin Will Hit $5 ‘Very Easy’ In 2025 – Analyst Additional Stimulus & Growth In TVL The dominance of Ethereum in the DeFi market was cemented when its total value locked surged by $4.81 billion within a period of one week. However, while other networks, including Base and Hyperliquid, had their TVLs rise, Ethereum is still viewed as the leader. Ethereum’s trajectory appears optimistic due to its robust ETF inflows, bullish technical outlook, and increasing TVL. Although it may require some time to accumulate $6,000, the narrative is compelling due to institutional support and steady momentum. Ethereum remains a fundamental component of the cryptocurrency market, combining investor confidence with innovation. Featured image from Pexels, chart from TradingView

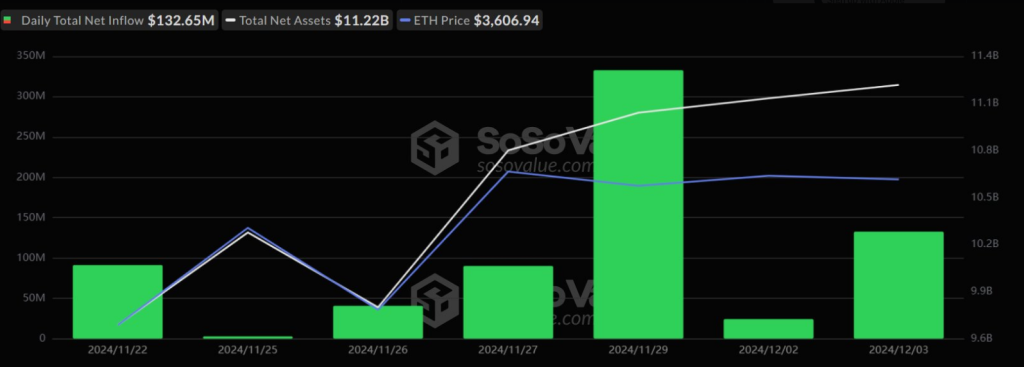

The increasing prominence of Ethereum is once again in the spotlight, as recent data indicates a substantial inflow of funds into Ether-based ETFs. These products have experienced a remarkable $133 million in net inflows over the course of seven days, indicating a significant increase in institutional interest and investor confidence.

Ethereum isn’t just optimistic about exchange-traded funds (ETFs). Analysts are making big price predictions for the cryptocurrency right now. This is because its network is being used more and more in decentralized finance (DeFi) and technical signs are showing that it will continue to rise.

On December 3, the total net inflow of Ethereum spot ETFs was $133 million, and net inflows continued for 7 consecutive days. The net inflow of Fidelity ETF FETH was $73.7239 million, and the net inflow of BlackRock ETF ETHA was $65.2929 million. https://t.co/Tvs2oCSxTg pic.twitter.com/HOPyOqmXGU

— Wu Blockchain (@WuBlockchain) December 4, 2024

Institutional Confidence And Strong ETF Inflows

A lot of people are interested in the Ethereum spot ETFs. Over $714 million has come into the top altcoin in the last week, showing that both institutional and individual buyers are becoming more interested in it. The ETHA ETF from BlackRock and the FETH ETF from Fidelity are leading the charge. Together, they have brought in about $140 million.

The support of major financial institutions is boosting activity and demonstrating that Ethereum is becoming popular in the conventional finance sector. This flood of capital demonstrates how Ethereum may unite centralized and decentralized financial systems.

Analysts Anticipate Mid-Term Target Of $6,000 For Ethereum

According to market experts, the level of support for Ethereum stands at $3,300. This is a safe place for investors to start because it strikes a good balance between risk and return. Analysts propose a mid-term price target of $6,000 in case Ethereum continues its ascent. Some analysts even anticipate a long-term price of $10,000.

If #Ethereum $ETH experiences a pullback, keep an eye on the $3,300 support level — a potential buying opportunity.

Our mid-term target remains $6,000, with a long-term outlook of $10,000! https://t.co/mQQOjrKBFM pic.twitter.com/OEvDIV0ZpD

— Ali (@ali_charts) December 4, 2024

Meanwhile, CoinCodex predicts that the price of Ethereum will have gone up by 6.17 percent to $4,052.34 by January 4, 2025. With an Extreme Greed number of 78 on the Fear & Greed Index and other technical indicators, it’s clear that people are planning to buy.

Extreme confidence in the market suggests significant growth potential, but it is still important to take into account the inherent volatility of cryptocurrency investments.

In the past 7 days, #Etherum‘s TVL increased by $4.81B, #Base‘s TVL increased by $302.02M, and #Hyperliquid‘s TVL increased by $290.21M.

Funds have flowed into #Ethereum, #Base, and #Hyperliquid. pic.twitter.com/YDZOGU0Esc

— Lookonchain (@lookonchain) December 2, 2024

Additional Stimulus & Growth In TVL

Additional Stimulus & Growth In TVL

The dominance of Ethereum in the DeFi market was cemented when its total value locked surged by $4.81 billion within a period of one week. However, while other networks, including Base and Hyperliquid, had their TVLs rise, Ethereum is still viewed as the leader.

Ethereum’s trajectory appears optimistic due to its robust ETF inflows, bullish technical outlook, and increasing TVL. Although it may require some time to accumulate $6,000, the narrative is compelling due to institutional support and steady momentum.

Ethereum remains a fundamental component of the cryptocurrency market, combining investor confidence with innovation.

Featured image from Pexels, chart from TradingView

What's Your Reaction?

.gif)