Ethereum Fees Hit 9-Month High Amid Strong DeFi Activity – Details

The price of Ethereum recorded an overall decline of 2.08% in the past week in line with the general performance of most altcoins. While the prominent cryptocurrency struggles to make any significant breakout past $4,000, certain developments on its underlying network have drawn investors’ attention. Related Reading: Ethereum Price Aims Higher: A Smooth Path To $4,000 and Beyond? Ethereum Weekly Fees Rise By 18% Amid DeFi Ecosystem Boom In a recent report on December 13, crypto analytics company IntoTheBlock stated that weekly Ethereum network fees rose by 17.9% in the past week reaching an estimated $67 million – the highest-ever value since April. According to analysts at IntoTheBlock, these high network fees can be attributed to ETH’s price balancing as Bitcoin retraced to $100,000. In addition, there has been a significant increase in DeFi activity on the Ethereum blockchain. Providing more insight into Ethereum’s vibrant DeFi ecosystem, the Satoshi Club highlights that DeFi lending has been on the rise, with traders leveraging their Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) to borrow stablecoins. These wrapped assets allow users to maximize their collateral utility by tapping into the liquidity and stability of DeFi protocols while maintaining exposure to major cryptocurrencies i.e. Bitcoin and Ethereum. Notably, the demand surge for lending drove interest rates to exceptional levels, now exceeding 10% on average and reaching as high as 40% on certain platforms. Interestingly, these figures mirror the peak dynamics seen in the 2022 bull market. Aave, one of Ethereum’s major DeFi protocols with a TVL of $22.46 billion has been a focal point on this increased DeFi activity, recording an impressive $500 million in net inflows over the last week. While heightened network activity driven by increased DeFi activity can indicate growing interest in the Ethereum network, investors should note that elevated Ethereum fees will pose challenges for smaller users being rewarding only for those who can capitalize on high interest rates. Related Reading: Ethereum Price Preps for Breakout: Will Bulls Drive a Massive Upswing? ETH Price Overview At the time of writing, Ethereum trades at $3,914.08 reflecting a minor loss of 0.22% in the past day. On the other hand, the altcoin is up by 21.39% on its monthly chart representing its stellar performance in the past few weeks As earlier stated, Ethereum’s most immediate resistance is the $4,000 price zone which has offered much opposition to price growth since the start of December. By breaking past this price barrier, Ethereum is likely to surge to $4,900 which represents its current all-time high and next significant price resistance. With a market cap of $471.16 billion, Ethereum remains the second-largest cryptocurrency representing 12.9% of the total digital assets market. Featured image from Empiricus, chart from Tradingview

The price of Ethereum recorded an overall decline of 2.08% in the past week in line with the general performance of most altcoins. While the prominent cryptocurrency struggles to make any significant breakout past $4,000, certain developments on its underlying network have drawn investors’ attention.

Ethereum Weekly Fees Rise By 18% Amid DeFi Ecosystem Boom

In a recent report on December 13, crypto analytics company IntoTheBlock stated that weekly Ethereum network fees rose by 17.9% in the past week reaching an estimated $67 million – the highest-ever value since April.

According to analysts at IntoTheBlock, these high network fees can be attributed to ETH’s price balancing as Bitcoin retraced to $100,000. In addition, there has been a significant increase in DeFi activity on the Ethereum blockchain.

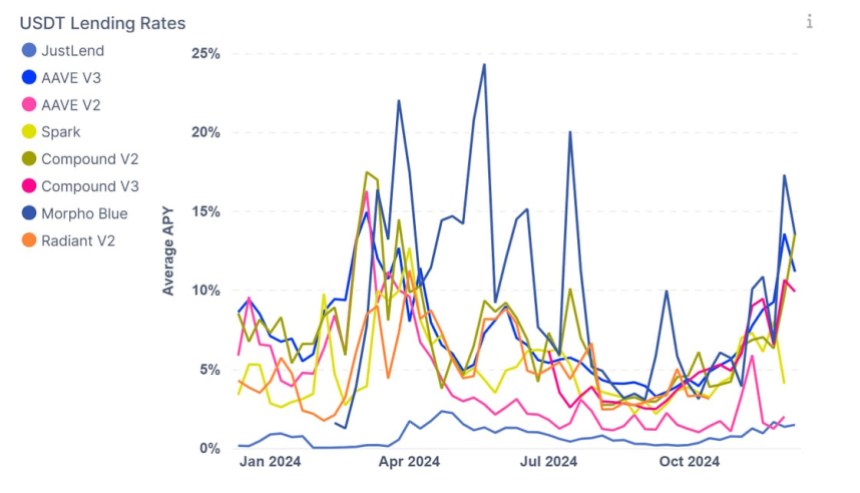

Providing more insight into Ethereum’s vibrant DeFi ecosystem, the Satoshi Club highlights that DeFi lending has been on the rise, with traders leveraging their Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) to borrow stablecoins. These wrapped assets allow users to maximize their collateral utility by tapping into the liquidity and stability of DeFi protocols while maintaining exposure to major cryptocurrencies i.e. Bitcoin and Ethereum.

Notably, the demand surge for lending drove interest rates to exceptional levels, now exceeding 10% on average and reaching as high as 40% on certain platforms. Interestingly, these figures mirror the peak dynamics seen in the 2022 bull market.

Aave, one of Ethereum’s major DeFi protocols with a TVL of $22.46 billion has been a focal point on this increased DeFi activity, recording an impressive $500 million in net inflows over the last week.

While heightened network activity driven by increased DeFi activity can indicate growing interest in the Ethereum network, investors should note that elevated Ethereum fees will pose challenges for smaller users being rewarding only for those who can capitalize on high interest rates.

ETH Price Overview

At the time of writing, Ethereum trades at $3,914.08 reflecting a minor loss of 0.22% in the past day. On the other hand, the altcoin is up by 21.39% on its monthly chart representing its stellar performance in the past few weeks

As earlier stated, Ethereum’s most immediate resistance is the $4,000 price zone which has offered much opposition to price growth since the start of December. By breaking past this price barrier, Ethereum is likely to surge to $4,900 which represents its current all-time high and next significant price resistance.

With a market cap of $471.16 billion, Ethereum remains the second-largest cryptocurrency representing 12.9% of the total digital assets market.

What's Your Reaction?

.gif)