Ethereum Price Could Still Reclaim $4,000 Based On This Bullish Divergence

The Ethereum price appeared to be finally gearing for a strong bullish breakout after multiple weeks of disappointing and sluggish action. However, this bullish dream ended almost immediately after it started as nearly $1.5 billion worth of ETH tokens were drained from the ByBit exchange. Ethereum, which traded as high as $2,840 earlier on Friday, February 21, dropped towards $2,600 on the back of news of the ByBit hack. Interestingly, recent on-chain data suggests that the altcoin’s price could still make its way to $4,000 before the end of this cycle. Could ETH Price Still Record A 60% Rally This Cycle? In a Quicktake post on the CryptoQuant platform, an analyst with the pseudonym Crypto Sunmoon identified a particular bullish divergence that offers insight into the Ethereum price performance in the near future. This bullish observation is based on recent movements of ETH’s “taker buy/sell ratio” across all exchanges. Related Reading: Dogecoin Price On The Edge: Breakout Or Breakdown—What’s Next? This metric measures the taker buy and taker sell volumes for a specific cryptocurrency (Ethereum, in this case). When the taker buy/sell ratio is greater than one, it implies that the taker buy volume is higher than the taker sell volume. This is typically considered a bullish signal, indicating the willingness of investors to pay a higher price for an asset. On the contrary, a less-than-one taker buy/sell ratio indicates that sellers are overwhelming the buyers in the market. This scenario suggests that more sellers are willing to offload their assets at a lower price, signaling a bearish shift in investor sentiment. Crypto Sunmoon noted that the 100-day exponential moving average (EMA) of the Ethereum taker buy/sell ratio on all exchanges has been rising in recent weeks. The Ethereum price, on the other hand, has been declining since mid-December. According to the analyst, this divergence is positive, as it indicates that a bearish trend has ended and an upward trend could be starting. The last time this bullish divergence occurred, the Ethereum price traveled from beneath $2,500 to above $4,000 (over 60% rally). While investors would view a reclaim of $3,000 as a victory for Ethereum, history and this bullish divergence suggest that the altcoin’s price could still climb toward the $4,000 mark before the end of the current cycle. Ethereum Price At A Glance As of this writing, the price of Ethereum stands around $2,650, reflecting a nearly 4% decline in the past 24 hours. Related Reading: More Pain Ahead For Solana? Dangerous Price Drop To $125 Looms With This Support Retest Featured image from iStock, chart from TradingView

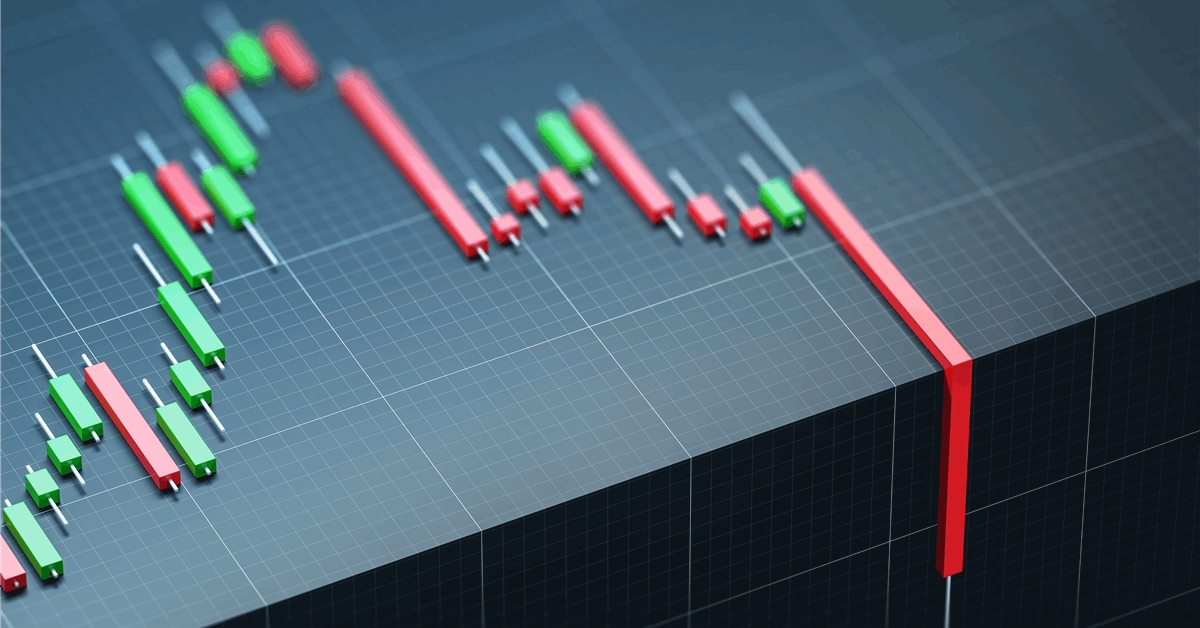

The Ethereum price appeared to be finally gearing for a strong bullish breakout after multiple weeks of disappointing and sluggish action. However, this bullish dream ended almost immediately after it started as nearly $1.5 billion worth of ETH tokens were drained from the ByBit exchange.

Ethereum, which traded as high as $2,840 earlier on Friday, February 21, dropped towards $2,600 on the back of news of the ByBit hack. Interestingly, recent on-chain data suggests that the altcoin’s price could still make its way to $4,000 before the end of this cycle.

Could ETH Price Still Record A 60% Rally This Cycle?

In a Quicktake post on the CryptoQuant platform, an analyst with the pseudonym Crypto Sunmoon identified a particular bullish divergence that offers insight into the Ethereum price performance in the near future. This bullish observation is based on recent movements of ETH’s “taker buy/sell ratio” across all exchanges.

This metric measures the taker buy and taker sell volumes for a specific cryptocurrency (Ethereum, in this case). When the taker buy/sell ratio is greater than one, it implies that the taker buy volume is higher than the taker sell volume. This is typically considered a bullish signal, indicating the willingness of investors to pay a higher price for an asset.

On the contrary, a less-than-one taker buy/sell ratio indicates that sellers are overwhelming the buyers in the market. This scenario suggests that more sellers are willing to offload their assets at a lower price, signaling a bearish shift in investor sentiment.

Crypto Sunmoon noted that the 100-day exponential moving average (EMA) of the Ethereum taker buy/sell ratio on all exchanges has been rising in recent weeks. The Ethereum price, on the other hand, has been declining since mid-December.

According to the analyst, this divergence is positive, as it indicates that a bearish trend has ended and an upward trend could be starting. The last time this bullish divergence occurred, the Ethereum price traveled from beneath $2,500 to above $4,000 (over 60% rally).

While investors would view a reclaim of $3,000 as a victory for Ethereum, history and this bullish divergence suggest that the altcoin’s price could still climb toward the $4,000 mark before the end of the current cycle.

Ethereum Price At A Glance

As of this writing, the price of Ethereum stands around $2,650, reflecting a nearly 4% decline in the past 24 hours.

What's Your Reaction?

.gif)