Ethereum Profit Streak Signals ATH Breakout For Over 90% Of Investors

Ethereum (ETH) is once again in the news, but this time it’s good news for buyers. Recent data shows that over 90% of Ethereum users are now making money because the price of the cryptocurrency has risen to impressive levels. According to IntoTheBlock, this upward trend is the best time in five months for people who own ETH to make profits. Related Reading: Elon Musk’s D.O.G.E. Targets The IRS: Taxman In The Crosshairs Of Budget Cuts Inspired by Bitcoin’s comeback above $96,000, the token jumped to $3,680, its biggest level since June. While Bitcoin cleared the path, Ethereum’s momentum is clearly seen since it broke barriers with ease. Though trading 25% below its all-time high (ATH) of $4,890, Ethereum’s fundamentals and market vibe point to a bright future ahead. 90.8% of $ETH holders are now in profit, the highest since June. Interestingly, the 9.2% of holders still at a loss hold just 2.8% of the total supply. This suggests that potential sell pressure from this group may have a limited impact as $ETH continues to trend upward. pic.twitter.com/qG4Xgi0Cq3 — IntoTheBlock (@intotheblock) November 28, 2024 Whale Confidence And Long-Term Holding More positive news comes from closer examination of the investment patterns of Ethereum. Only 9.2% of ETH holders are currently losing money, and they hold only 2.8% of the entire token count. This means that the market is unlikely to be much affected by any selling pressure these investors create. On top of that, Ethereum’s long-term holder base is also strong. The number of ETH holders holding more than one year has risen to approximately 74%, which signifies confidence in the token’s long-term value. Considering that only 23% of ETH were purchased last year and only 3% last month, most of the investors seem to be holding out for the long run. Decreasing Supply, Bullish Momentum Another reason giving a bullish outlook to Ethereum is the declining supply on centralized exchanges. According to analysts, it has continued to decline since last year, reducing ETH on centralized reserves. The more demand there is that outpaces the supply during a bull run, the higher the prices go. Ethereum’s recent surge has also been aided by huge inflows into spot ETFs, which have over $90 million. These institutional investments demonstrate rising trust in Ethereum’s future. Related Reading: Storm Ahead? Bitcoin Price Could Tumble 20% Due To M2 Supply Concerns Ethereum: Path To ATH Appears Clear ETH is already outperforming the larger crypto market, with a weekly gain of 12%. Its ETH/BTC ratio has risen by 18%, indicating strength relative to Bitcoin. Analysts feel that if Ethereum can retest and surpass the $4,000 resistance, the path to its all-time high would become more convincing. With 5.92% increased values over the previous day, its price has decreased slightly to $3,610, as of writing. From the indications and market’s sentiment, Ethereum has a tendency to rewrite the previous high to further break ground. Featured image from DALL-E, chart from TradingView

Ethereum (ETH) is once again in the news, but this time it’s good news for buyers. Recent data shows that over 90% of Ethereum users are now making money because the price of the cryptocurrency has risen to impressive levels. According to IntoTheBlock, this upward trend is the best time in five months for people who own ETH to make profits.

Inspired by Bitcoin’s comeback above $96,000, the token jumped to $3,680, its biggest level since June. While Bitcoin cleared the path, Ethereum’s momentum is clearly seen since it broke barriers with ease. Though trading 25% below its all-time high (ATH) of $4,890, Ethereum’s fundamentals and market vibe point to a bright future ahead.

90.8% of $ETH holders are now in profit, the highest since June.

Interestingly, the 9.2% of holders still at a loss hold just 2.8% of the total supply. This suggests that potential sell pressure from this group may have a limited impact as $ETH continues to trend upward. pic.twitter.com/qG4Xgi0Cq3

— IntoTheBlock (@intotheblock) November 28, 2024

Whale Confidence And Long-Term Holding

More positive news comes from closer examination of the investment patterns of Ethereum. Only 9.2% of ETH holders are currently losing money, and they hold only 2.8% of the entire token count. This means that the market is unlikely to be much affected by any selling pressure these investors create.

On top of that, Ethereum’s long-term holder base is also strong. The number of ETH holders holding more than one year has risen to approximately 74%, which signifies confidence in the token’s long-term value. Considering that only 23% of ETH were purchased last year and only 3% last month, most of the investors seem to be holding out for the long run.

Decreasing Supply, Bullish Momentum

Another reason giving a bullish outlook to Ethereum is the declining supply on centralized exchanges. According to analysts, it has continued to decline since last year, reducing ETH on centralized reserves. The more demand there is that outpaces the supply during a bull run, the higher the prices go.

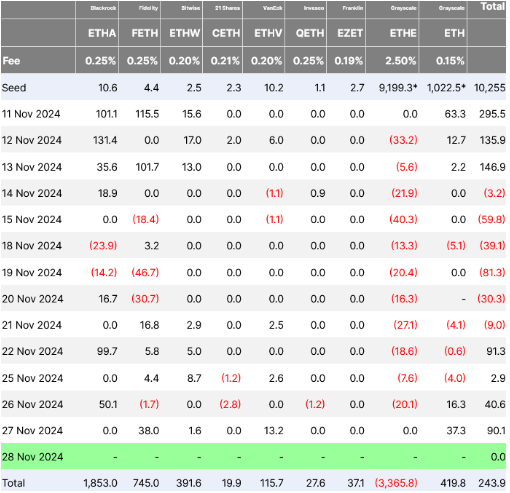

Ethereum’s recent surge has also been aided by huge inflows into spot ETFs, which have over $90 million. These institutional investments demonstrate rising trust in Ethereum’s future.

Ethereum: Path To ATH Appears Clear

Ethereum: Path To ATH Appears Clear

ETH is already outperforming the larger crypto market, with a weekly gain of 12%. Its ETH/BTC ratio has risen by 18%, indicating strength relative to Bitcoin. Analysts feel that if Ethereum can retest and surpass the $4,000 resistance, the path to its all-time high would become more convincing.

With 5.92% increased values over the previous day, its price has decreased slightly to $3,610, as of writing. From the indications and market’s sentiment, Ethereum has a tendency to rewrite the previous high to further break ground.

Featured image from DALL-E, chart from TradingView

What's Your Reaction?

.gif)