New ATH: Bitcoin Tops $106K—Is FOMO And Strategic Reserve The Game-Changer?

With a new all-time high, Bitcoin is once again the talk of the crypto world. In the rough history of the alpha cryptocurrency, breaking through the key $106,000 mark on December 16, 2024, was a big moment. Investors are more confident now that Donald Trump won the election, which was based on his campaign promises. ???? #BTC hits $106K! The crypto sky just got brighter—what’s your next move? ???? https://t.co/0XLTbaOUoL pic.twitter.com/VxWzZRx83M — Gate.io (@gate_io) December 16, 2024 A New Era For Bitcoin The excitement over Bitcoin stems from more than just numbers; it also comes from the possibility for a change in legislative attitudes. The victory of Trump has led to a general opinion that his government will be more open to cryptocurrencies than the previous administration. He plans to designate pro-crypto leaders to important roles, including Paul Atkins as the Securities and Exchange Commission (SEC) new director. This has inspired hope for a more flexible regulatory framework, which many feel will help to raise the value of Bitcoin even more. Related Reading: 3-Year Peak: Chainlink Rally Fueled By Historic Open Interest Levels Bitcoin’s price has increased by nearly 50% in the span of just over a month since Trump’s election. According to experts, investors’ “fear of missing out” (FOMO) is the primary driver of this increase. The approval of Bitcoin exchange-traded funds (ETFs) earlier this year was also instrumental in attracting mainstream investors, facilitating their entry into the market. Bitcoin’s aggregate market capitalization has now surpassed $3.8 trillion as a result of these developments. Managing The Volatility Though there is obvious excitement right now, experts caution investors about Bitcoin’s known volatility. Financial advisers suggest that a portfolio should include about 5% of cryptocurrencies. They underscore the significance of a disciplined approach that effectively balances the inherent risks with the potential benefits. Historical data indicates that Bitcoin is capable of experiencing significant price fluctuations, as evidenced by its 70% decline in 2021 following its previous high. Many are riding the tide of optimism, despite these warnings. Also fueling the rise of Bitcoin is the expectation that the Federal Reserve may cut interest rates this week. When financing costs are low, riskier assets, like cryptocurrencies, tend to do well because of lower interest rates. Related Reading: Massive Dogecoin Rally Incoming: Bigger And Better Than 2021 — Analyst Uncertain And Promising As Bitcoin keeps breaking new benchmarks, its future is both unknown but also bright. The possibility for a national strategic reserve for Bitcoin under Trump’s presidency has generated discussion among analysts and investors. This idea has the same resemblance to traditional oil reserves and could help Bitcoin’s place in the financial system to be consolidated. Featured image from Euronews, chart from TradingView

With a new all-time high, Bitcoin is once again the talk of the crypto world. In the rough history of the alpha cryptocurrency, breaking through the key $106,000 mark on December 16, 2024, was a big moment. Investors are more confident now that Donald Trump won the election, which was based on his campaign promises.

#BTC hits $106K!

The crypto sky just got brighter—what’s your next move?

https://t.co/0XLTbaOUoL pic.twitter.com/VxWzZRx83M

— Gate.io (@gate_io) December 16, 2024

A New Era For Bitcoin

The excitement over Bitcoin stems from more than just numbers; it also comes from the possibility for a change in legislative attitudes. The victory of Trump has led to a general opinion that his government will be more open to cryptocurrencies than the previous administration.

He plans to designate pro-crypto leaders to important roles, including Paul Atkins as the Securities and Exchange Commission (SEC) new director. This has inspired hope for a more flexible regulatory framework, which many feel will help to raise the value of Bitcoin even more.

Bitcoin’s price has increased by nearly 50% in the span of just over a month since Trump’s election. According to experts, investors’ “fear of missing out” (FOMO) is the primary driver of this increase.

The approval of Bitcoin exchange-traded funds (ETFs) earlier this year was also instrumental in attracting mainstream investors, facilitating their entry into the market. Bitcoin’s aggregate market capitalization has now surpassed $3.8 trillion as a result of these developments.

Managing The Volatility

Though there is obvious excitement right now, experts caution investors about Bitcoin’s known volatility. Financial advisers suggest that a portfolio should include about 5% of cryptocurrencies.

They underscore the significance of a disciplined approach that effectively balances the inherent risks with the potential benefits. Historical data indicates that Bitcoin is capable of experiencing significant price fluctuations, as evidenced by its 70% decline in 2021 following its previous high.

Many are riding the tide of optimism, despite these warnings. Also fueling the rise of Bitcoin is the expectation that the Federal Reserve may cut interest rates this week. When financing costs are low, riskier assets, like cryptocurrencies, tend to do well because of lower interest rates. Uncertain And Promising

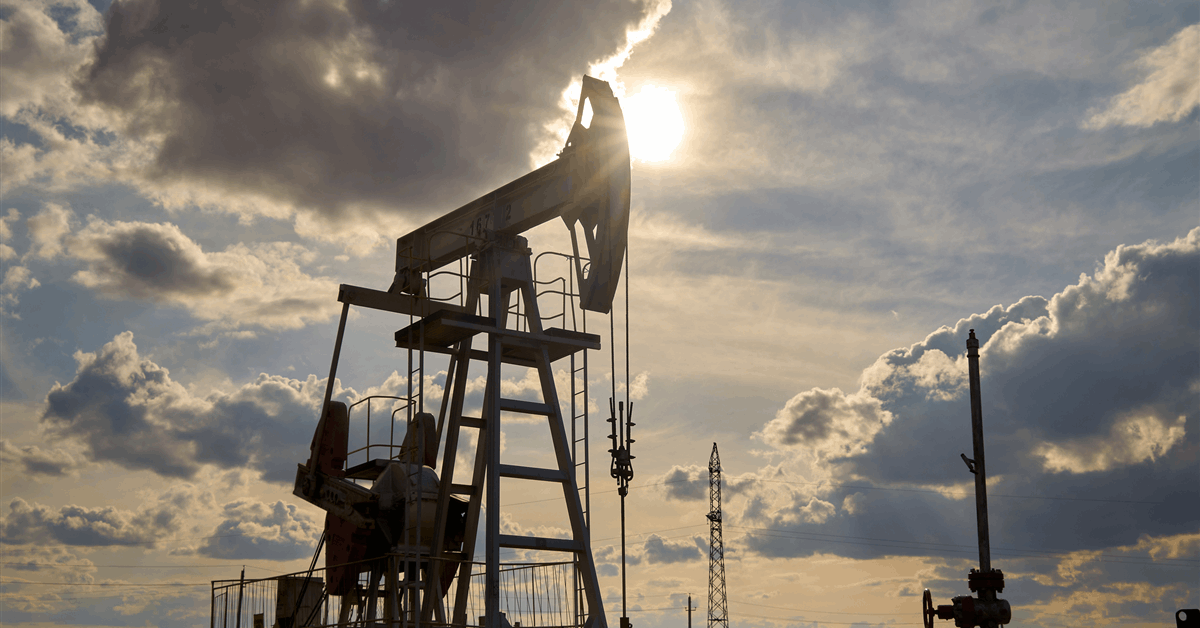

As Bitcoin keeps breaking new benchmarks, its future is both unknown but also bright. The possibility for a national strategic reserve for Bitcoin under Trump’s presidency has generated discussion among analysts and investors. This idea has the same resemblance to traditional oil reserves and could help Bitcoin’s place in the financial system to be consolidated.

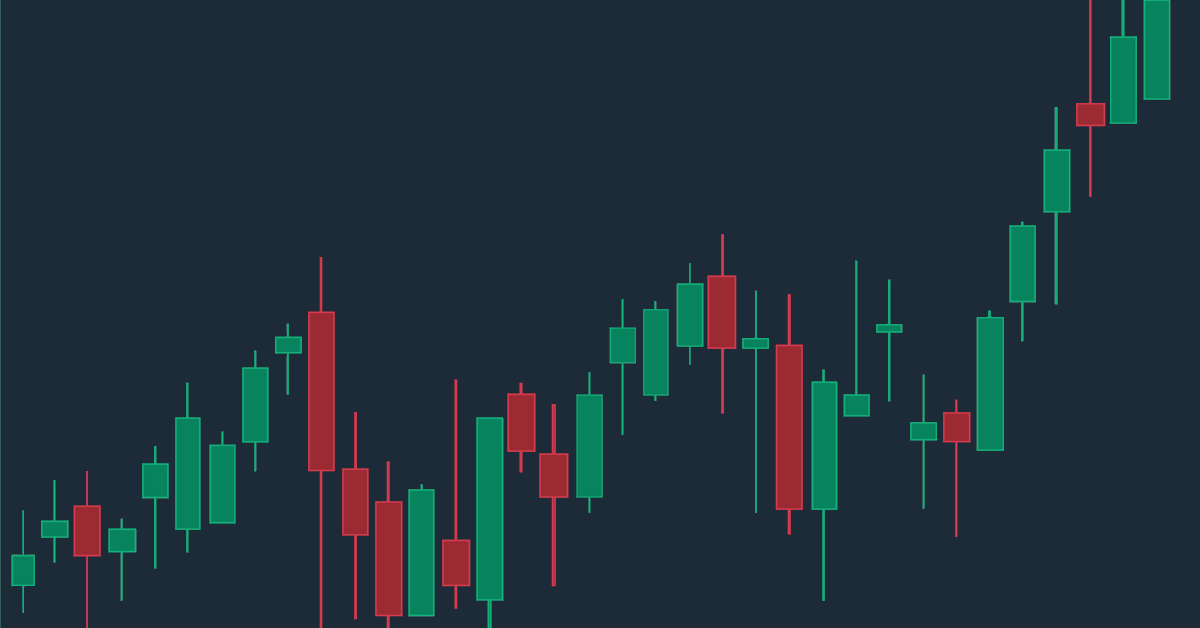

Featured image from Euronews, chart from TradingView

What's Your Reaction?

.gif)