Solana At A Crux: Will SOL Crash To $120 Accelerated By These Factors?

Solana remains one of the top-performing crypto assets over the past year. Even though there is a retracement from the 2024 highs, the coin is still multiples higher than the 2022 lows. Traders are upbeat about what lies ahead, with some convinced the coin will easily break $260 and register all-time highs in the coming months. Like Bitcoin, Ethereum, and other top altcoins like Cardano, SOL faces determined sellers. From the daily chart, SOL is moving sideways in a possible accumulation, considering the current primary trend remains upward. However, on lower time frames, one trader thinks SOL might struggle in the coming few sessions. SOL Holders To Prepare For More Pain? Taking to X has picked out a head and short formation in the hourly chart. Technically, this candlestick pattern is associated with weakness. Of note is that this formation prints when the coin consolidates inside the bear range from July 28 through August 5. Related Reading: HODLing Resurgence? 374,000 Bitcoin Transfer Ignites Crypto Recovery From the daily chart, SOL faces strong resistance at an August 8 high of $162. On the lower end, support is at $142. The sideways movement and fluctuation inside this range have formed a bear flag–another selling signal, especially if sellers of late July and early August press on. In the hourly chart, the immediate resistance is around $150, marking the tip of the head. However, the top of the shoulder is at around $146. Meanwhile, the baseline of this pattern is at $142, coinciding with the critical support in the daily chart. Therefore, reading from the above candlestick formation means that traders should prepare for more pain unless Solana bulls push higher. A break below $142 in the daily chart sets the ball rolling for aggressive sellers targeting June and July lows of around $120. Solana Challenges: Centralization Claims, High Transaction Processing Failure Rate The upside momentum, looking at other developments besides candlestick formation, is fizzling out. Last week, a severe security flaw was discovered and quickly patched. Related Reading: Bitcoin Poised To Reach New All-Time Highs: Expert Dives Into Tether’s Role As The Key The critical vulnerability, analysts said, had the potential to cripple the whole network. What’s concerning is that even considering the severity of the flaw, the Solana Foundation and developers chose a “quiet” fix, calling into question Solana’s decentralization level. Additionally, Solana has been struggling with high transaction processing failures. According to trading data from Jupiter, a top DEX on Solana, only about 35% of all transactions posted go through. A big chunk, or 65% of all transactions, fail. The high failure rate significantly undermines some of the platform’s key selling points, mainly its low fees and high scalability. Feature image from DALLE, chart from TradingView

Solana remains one of the top-performing crypto assets over the past year. Even though there is a retracement from the 2024 highs, the coin is still multiples higher than the 2022 lows.

Traders are upbeat about what lies ahead, with some convinced the coin will easily break $260 and register all-time highs in the coming months.

Like Bitcoin, Ethereum, and other top altcoins like Cardano, SOL faces determined sellers. From the daily chart, SOL is moving sideways in a possible accumulation, considering the current primary trend remains upward. However, on lower time frames, one trader thinks SOL might struggle in the coming few sessions.

SOL Holders To Prepare For More Pain?

Taking to X has picked out a head and short formation in the hourly chart. Technically, this candlestick pattern is associated with weakness. Of note is that this formation prints when the coin consolidates inside the bear range from July 28 through August 5.

From the daily chart, SOL faces strong resistance at an August 8 high of $162. On the lower end, support is at $142. The sideways movement and fluctuation inside this range have formed a bear flag–another selling signal, especially if sellers of late July and early August press on.

In the hourly chart, the immediate resistance is around $150, marking the tip of the head. However, the top of the shoulder is at around $146. Meanwhile, the baseline of this pattern is at $142, coinciding with the critical support in the daily chart.

Therefore, reading from the above candlestick formation means that traders should prepare for more pain unless Solana bulls push higher. A break below $142 in the daily chart sets the ball rolling for aggressive sellers targeting June and July lows of around $120.

Solana Challenges: Centralization Claims, High Transaction Processing Failure Rate

The upside momentum, looking at other developments besides candlestick formation, is fizzling out. Last week, a severe security flaw was discovered and quickly patched.

The critical vulnerability, analysts said, had the potential to cripple the whole network. What’s concerning is that even considering the severity of the flaw, the Solana Foundation and developers chose a “quiet” fix, calling into question Solana’s decentralization level.

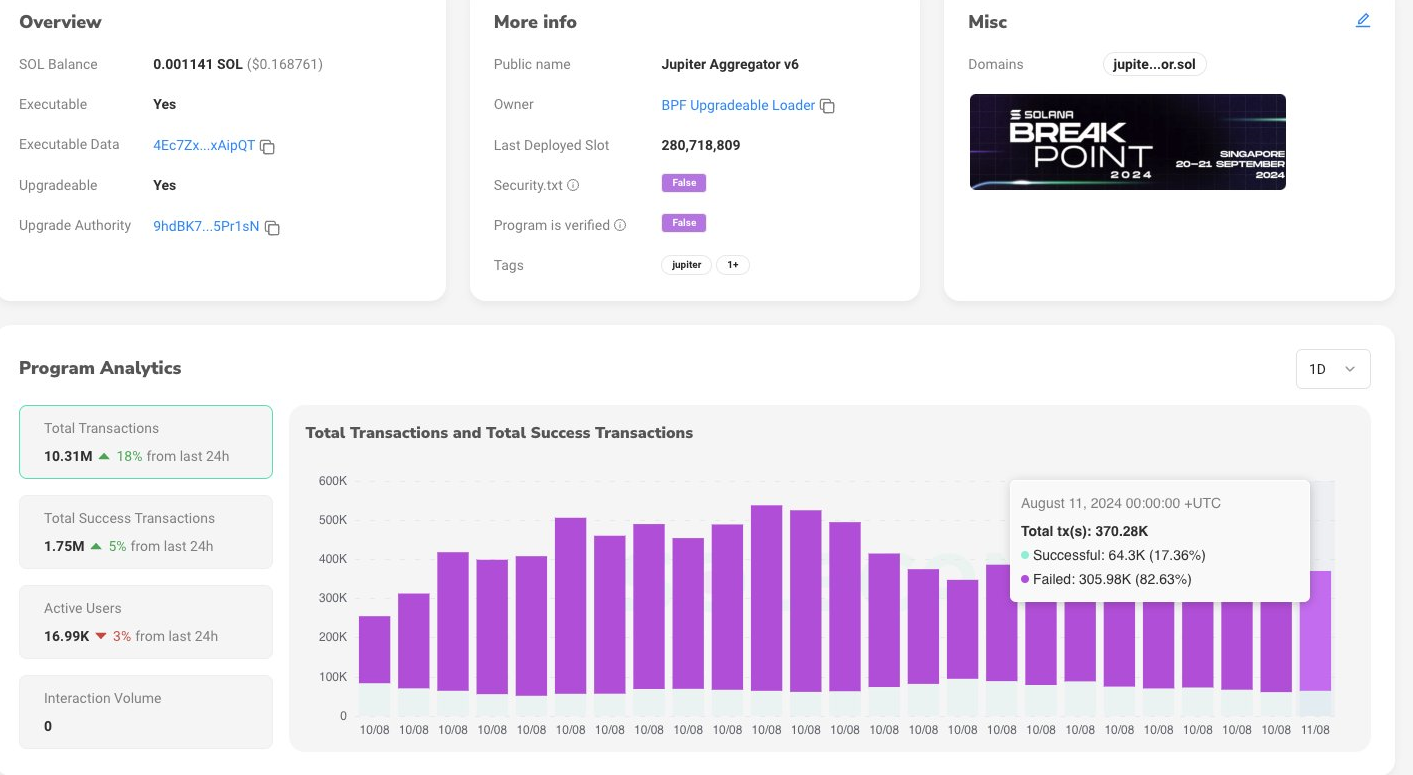

Additionally, Solana has been struggling with high transaction processing failures. According to trading data from Jupiter, a top DEX on Solana, only about 35% of all transactions posted go through.

A big chunk, or 65% of all transactions, fail. The high failure rate significantly undermines some of the platform’s key selling points, mainly its low fees and high scalability.

What's Your Reaction?

.gif)