Solana (SOL) Encounters Barriers: Is a Fresh Surge Still Possible?

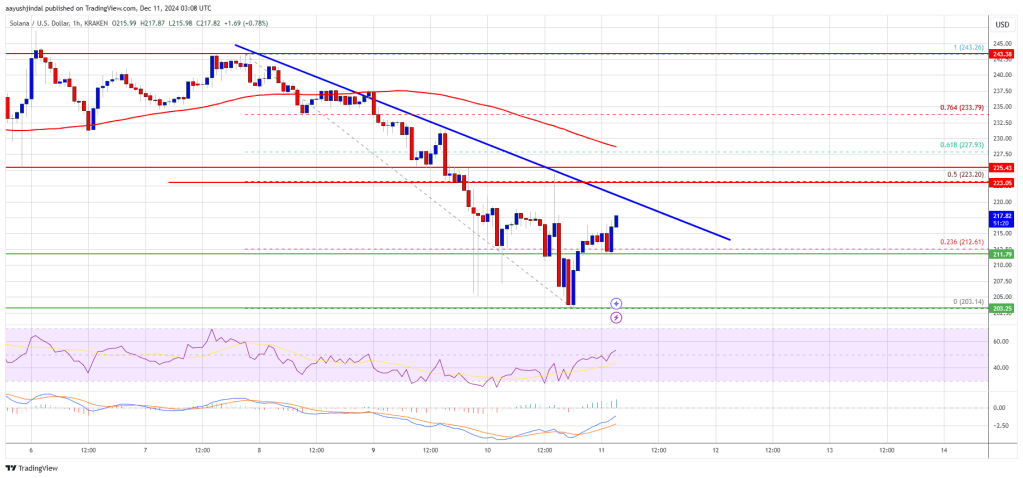

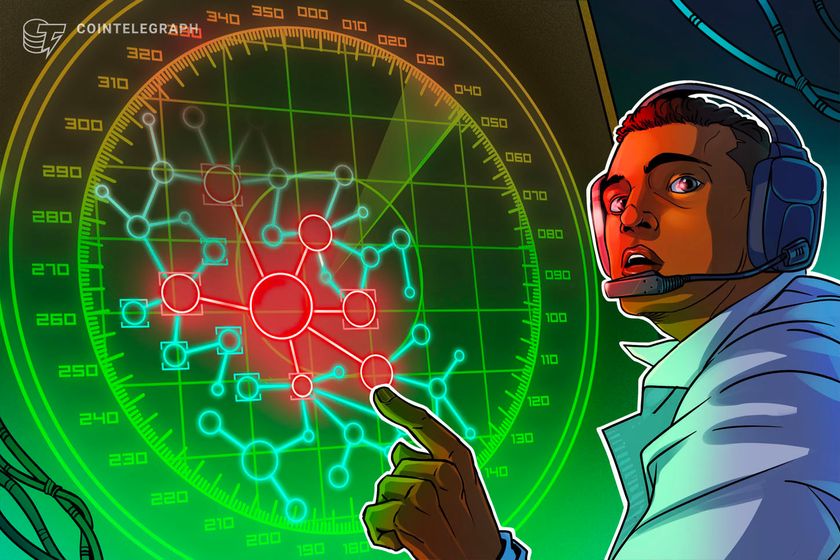

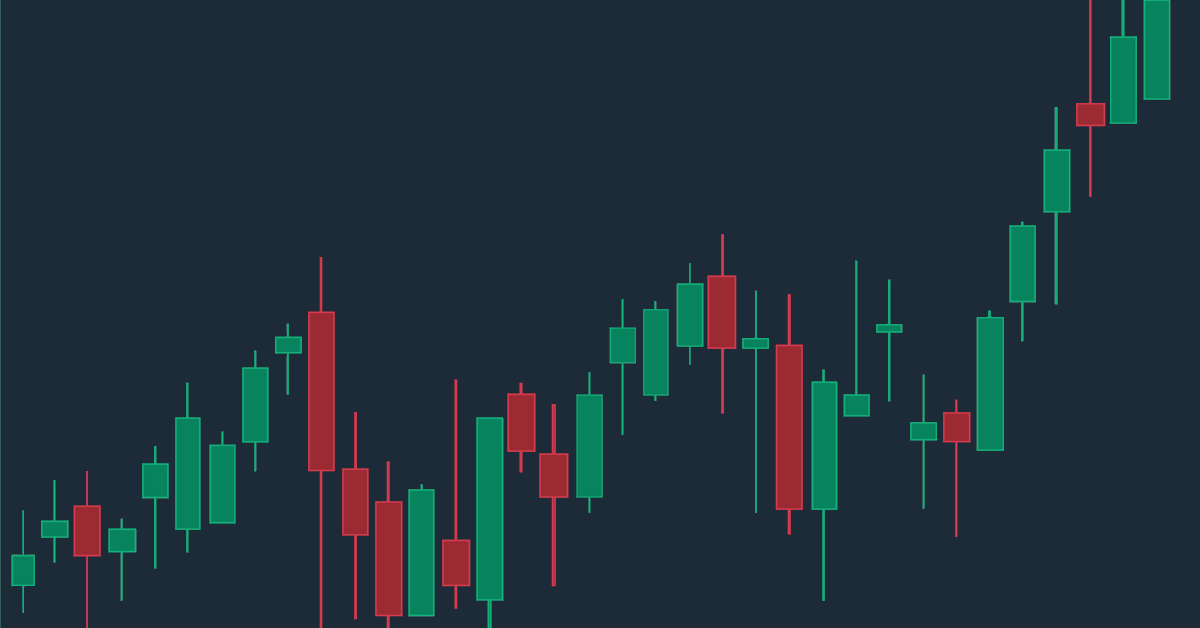

Solana started a downside correction below the $230 zone. SOL price is now recovering losses and facing hurdles near the $220 level. SOL price started a fresh increase after it tested the $204 zone against the US Dollar. The price is now trading below $230 and the 100-hourly simple moving average. There is a key bearish trend line forming with resistance at $220 on the hourly chart of the SOL/USD pair (data source from Kraken). The pair could start a fresh increase if the bulls clear the $220 zone. Solana Price Eyes Upside Break Solana price formed a support base and started a fresh increase from the $204 level like Bitcoin and Ethereum. There was a decent increase above the $210 and $212 resistance levels. There was a move above the 23.6% Fib retracement level of the downward move from the $243 swing high to the $203 low. However, the price is now facing many hurdles near $220. Solana is now trading above $218 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $220 level. There is also a key bearish trend line forming with resistance at $220 on the hourly chart of the SOL/USD pair. The next major resistance is near the $224 level or the 50% Fib retracement level of the downward move from the $243 swing high to the $203 low. The main resistance could be $228. A successful close above the $228 resistance level could set the pace for another steady increase. The next key resistance is $235. Any more gains might send the price toward the $250 level. Another Decline in SOL? If SOL fails to rise above the $220 resistance, it could start another decline. Initial support on the downside is near the $212 level. The first major support is near the $205 level. A break below the $205 level might send the price toward the $200 zone. If there is a close below the $200 support, the price could decline toward the $188 support in the near term. Technical Indicators Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone. Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level. Major Support Levels – $212 and $205. Major Resistance Levels – $220 and $228.

Solana started a downside correction below the $230 zone. SOL price is now recovering losses and facing hurdles near the $220 level.

- SOL price started a fresh increase after it tested the $204 zone against the US Dollar.

- The price is now trading below $230 and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $220 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if the bulls clear the $220 zone.

Solana Price Eyes Upside Break

Solana price formed a support base and started a fresh increase from the $204 level like Bitcoin and Ethereum. There was a decent increase above the $210 and $212 resistance levels.

There was a move above the 23.6% Fib retracement level of the downward move from the $243 swing high to the $203 low. However, the price is now facing many hurdles near $220. Solana is now trading above $218 and the 100-hourly simple moving average.

On the upside, the price is facing resistance near the $220 level. There is also a key bearish trend line forming with resistance at $220 on the hourly chart of the SOL/USD pair.

The next major resistance is near the $224 level or the 50% Fib retracement level of the downward move from the $243 swing high to the $203 low. The main resistance could be $228. A successful close above the $228 resistance level could set the pace for another steady increase. The next key resistance is $235. Any more gains might send the price toward the $250 level.

Another Decline in SOL?

If SOL fails to rise above the $220 resistance, it could start another decline. Initial support on the downside is near the $212 level. The first major support is near the $205 level.

A break below the $205 level might send the price toward the $200 zone. If there is a close below the $200 support, the price could decline toward the $188 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $212 and $205.

Major Resistance Levels – $220 and $228.

What's Your Reaction?

.gif)