Tron Lost 10% Since Last Week – Is There A Saving Grace Ahead?

Tron (TRX) faced huge losses after the market swung downward in a strong overreaction amidst macroeconomic fears. According to CoinGecko, the token is down nearly 6% since last week but has since turned a full 180 gaining almost a percent today, August 7th. Since then, the ecosystem continues to surprise the community with its strength Related Reading: ATOM Blows Up 10% After Significant Sell Pressure As the market also resumes some form of recovery with a percent uptick in the total market cap, TRX might see some growth in the coming days. Tron Remains Profitable Despite Market Bleed Bankless released a deep dive on the on-chain profitability of several layer 1s and layer 2s, including Tron on their long list of blockchains. Which blockchains are actually profitable? ???? This is the data behind the L1 and L2 networks driving the most revenue and earnings ???????? Today, we’ll explore the top 4 L1s and L2s by revenue, and explore just how much of the revenues that these blockchains actually keep. For… pic.twitter.com/TgudtrlDvO — Bankless (@BanklessHQ) August 1, 2024 According to their report, Tron is the most profitable chain at $271 million earned over the past year, with Solana being the lowest with over $2 billion in the negative. Tron is touted as a “silent giant”, boasting a whopping $1.4 billion in revenue over the past year. This is because of the platform’s significant investment in stablecoins, thus propping their stablecoin activity just behind Ethereum, the second-most prominent blockchain in the world. Another development that will increase stablecoin activity on the platform is TokenPocket, a crypto wallet provider, introducing a feature that uses Tether (USDT) to pay gas fees on TRX, providing convenience for users who want to use Tron despite not holding any of the token itself. ✅Use $USDT to cover gas fees on the #TRON network via TokenPocket! Check out how @Cointelegraph introduces this feature! @trondao #TRON ????https://t.co/90Kiwkc40W — TokenPocket (@TokenPocket_TP) August 3, 2024 How did this affect Tron’s position in the market? Well, the answer lies in the ever-growing stats that show a strong and growing community in the long run. According to Tron’s official website, the platform has processed over $8 billion in transactions with a whopping $19.6 billion in total value locked (TVL). Long-Term Growth Is Guaranteed At These Levels The token’s current positioning amid the bearish market is somewhat stable, settling around $0.1229 and $0.1271. TRX bears have already used this price range earlier this year which puts more pressure on the bulls to hold on to this support range for a future breakthrough. Related Reading: Aave Protocol Unfazed By Market Jitters, Surges 21% TRX moves alongside Ethereum in the same manner as ETH following Bitcoin within the broader market. This might help with the token’s future performance as the market usually follows the two top cryptocurrencies as a gauge of the broader market’s bullishness or bearishness. As Bitcoin’s rebound slows to a crawl, TRX might face difficulties in achieving a breakthrough in the short term. However, this does not discredit the possibility of a bullish breakthrough in the mid to late August timeline which might be the time Bitcoin and Ethereum already recovers from the market overreaction this week. However, the market’s current volatile nature also may hamper any further attempt at short-term upward movement. The bulls should then continue holding on the $0.1229-$0.1271 price range to ensure a strong breakthrough in the long-term. Featured image from Publish0x, chart from TradingView

Tron (TRX) faced huge losses after the market swung downward in a strong overreaction amidst macroeconomic fears. According to CoinGecko, the token is down nearly 6% since last week but has since turned a full 180 gaining almost a percent today, August 7th. Since then, the ecosystem continues to surprise the community with its strength

As the market also resumes some form of recovery with a percent uptick in the total market cap, TRX might see some growth in the coming days.

Tron Remains Profitable Despite Market Bleed

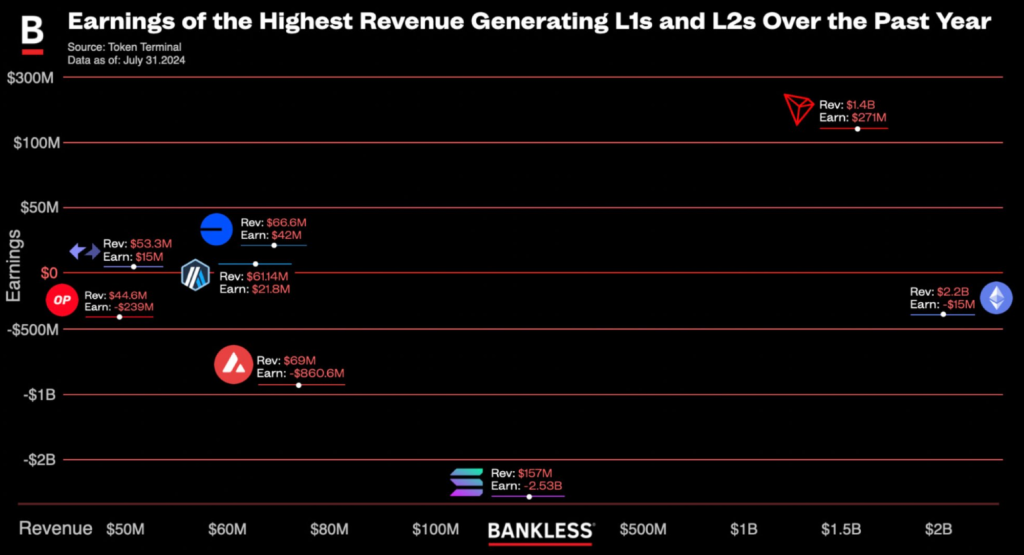

Bankless released a deep dive on the on-chain profitability of several layer 1s and layer 2s, including Tron on their long list of blockchains.

Which blockchains are actually profitable?

This is the data behind the L1 and L2 networks driving the most revenue and earnings

Today, we’ll explore the top 4 L1s and L2s by revenue, and explore just how much of the revenues that these blockchains actually keep.

For… pic.twitter.com/TgudtrlDvO

— Bankless (@BanklessHQ) August 1, 2024

According to their report, Tron is the most profitable chain at $271 million earned over the past year, with Solana being the lowest with over $2 billion in the negative.

Tron is touted as a “silent giant”, boasting a whopping $1.4 billion in revenue over the past year. This is because of the platform’s significant investment in stablecoins, thus propping their stablecoin activity just behind Ethereum, the second-most prominent blockchain in the world.

Another development that will increase stablecoin activity on the platform is TokenPocket, a crypto wallet provider, introducing a feature that uses Tether (USDT) to pay gas fees on TRX, providing convenience for users who want to use Tron despite not holding any of the token itself.

Use $USDT to cover gas fees on the #TRON network via TokenPocket!

Check out how @Cointelegraph introduces this feature! @trondao #TRON

https://t.co/90Kiwkc40W

— TokenPocket (@TokenPocket_TP) August 3, 2024

How did this affect Tron’s position in the market? Well, the answer lies in the ever-growing stats that show a strong and growing community in the long run. According to Tron’s official website, the platform has processed over $8 billion in transactions with a whopping $19.6 billion in total value locked (TVL).

Long-Term Growth Is Guaranteed At These Levels

The token’s current positioning amid the bearish market is somewhat stable, settling around $0.1229 and $0.1271. TRX bears have already used this price range earlier this year which puts more pressure on the bulls to hold on to this support range for a future breakthrough.

TRX moves alongside Ethereum in the same manner as ETH following Bitcoin within the broader market. This might help with the token’s future performance as the market usually follows the two top cryptocurrencies as a gauge of the broader market’s bullishness or bearishness.

As Bitcoin’s rebound slows to a crawl, TRX might face difficulties in achieving a breakthrough in the short term. However, this does not discredit the possibility of a bullish breakthrough in the mid to late August timeline which might be the time Bitcoin and Ethereum already recovers from the market overreaction this week.

However, the market’s current volatile nature also may hamper any further attempt at short-term upward movement. The bulls should then continue holding on the $0.1229-$0.1271 price range to ensure a strong breakthrough in the long-term.

Featured image from Publish0x, chart from TradingView

What's Your Reaction?

.gif)