When To Be Bearish On Bitcoin? On-Chain Analyst Answers

An on-chain analyst has explained signals in several metrics to see if Bitcoin is in a bearish phase. These Bitcoin Indicators Could Be To Follow For Bear Market Signals In a new post on X, on-chain analyst Checkmate replied to a user asking about an on-chain metric indicating when it’s time to turn bearish on cryptocurrency. Checkmate has shared two indicators: the Short-Term Holder Realized Profit/Loss Momentum and the Short-Term Holder MVRV Ratio Momentum. “Short-Term Holders” (STHs) here refer to the Bitcoin investors who bought their coins within the past 155 days, meaning that both of these metrics are only for the recent buyers in the market. Related Reading: Bitcoin Observes Pullback To $58,000: Is This The Cause? First, the “Realized Profit/Loss Momentum” measures, as its name suggests, the momentum in the ratio of the profit and loss that the STHs are realizing through their selling. Below is the chart for the indicator posted by the analyst. According to the analyst, it is time to be bearish when the oscillator on the bottom of this chart turns red (corresponding to negative momentum in the STH Realized Profit/Loss). The graph shows that this oscillator assumed negative values soon after the price set its new all-time high (ATH) and has since remained in the region. And indeed, while the indicator has seen these values, Bitcoin has been going through a rough phase. The STH MVRV Ratio Momentum’s second indicator works similarly and keeps track of the distance between the Market Value to Realized Value (MVRV) Ratio for this cohort and its 155-day moving average (MA). The MVRV Ratio is a popular indicator that tells us how the value held by the investors (the market cap) compares against what they used to purchase their coins (the Realized Cap). In other words, the metric provides information about the unrealized profit/loss of the holders. Thus, whereas the Realized Profit/Loss keeps track of the net profit/loss the investors are harvesting through their selling, this metric tells us about the profit/loss they have yet to take. Related Reading: This Is The On-Chain Level That Made The Bitcoin Crash Bottom Here is the data for the momentum indicator for the MVRV Ratio specifically for the STHs: According to the analyst, just like with the first indicator, this one also gives a bearish signal when the momentum turns red. As the chart shows, the STH MVRV Ratio has been under its 155-day MA for the same period as the bearish momentum in the Realized Profit/Loss, thus providing confluence to the signal. BTC Price Bitcoin had pushed towards $62,000 earlier in the week, but the asset has since slipped up as it’s now back at $57,800. Featured image from Dall-E, checkonchain.com, chart from TradingView.com

An on-chain analyst has explained signals in several metrics to see if Bitcoin is in a bearish phase.

These Bitcoin Indicators Could Be To Follow For Bear Market Signals

In a new post on X, on-chain analyst Checkmate replied to a user asking about an on-chain metric indicating when it’s time to turn bearish on cryptocurrency.

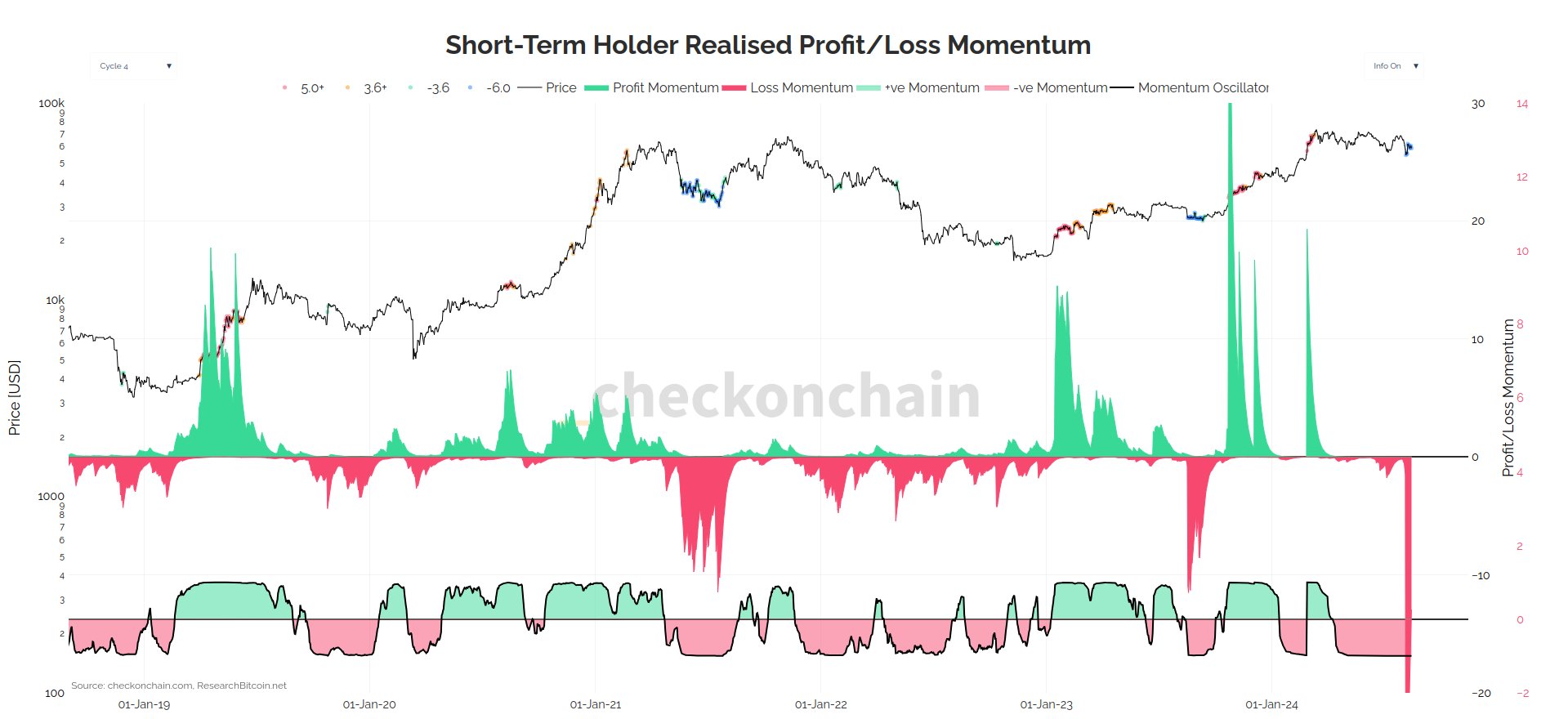

Checkmate has shared two indicators: the Short-Term Holder Realized Profit/Loss Momentum and the Short-Term Holder MVRV Ratio Momentum. “Short-Term Holders” (STHs) here refer to the Bitcoin investors who bought their coins within the past 155 days, meaning that both of these metrics are only for the recent buyers in the market.

First, the “Realized Profit/Loss Momentum” measures, as its name suggests, the momentum in the ratio of the profit and loss that the STHs are realizing through their selling.

Below is the chart for the indicator posted by the analyst.

According to the analyst, it is time to be bearish when the oscillator on the bottom of this chart turns red (corresponding to negative momentum in the STH Realized Profit/Loss).

The graph shows that this oscillator assumed negative values soon after the price set its new all-time high (ATH) and has since remained in the region. And indeed, while the indicator has seen these values, Bitcoin has been going through a rough phase.

The STH MVRV Ratio Momentum’s second indicator works similarly and keeps track of the distance between the Market Value to Realized Value (MVRV) Ratio for this cohort and its 155-day moving average (MA).

The MVRV Ratio is a popular indicator that tells us how the value held by the investors (the market cap) compares against what they used to purchase their coins (the Realized Cap). In other words, the metric provides information about the unrealized profit/loss of the holders.

Thus, whereas the Realized Profit/Loss keeps track of the net profit/loss the investors are harvesting through their selling, this metric tells us about the profit/loss they have yet to take.

Here is the data for the momentum indicator for the MVRV Ratio specifically for the STHs:

According to the analyst, just like with the first indicator, this one also gives a bearish signal when the momentum turns red. As the chart shows, the STH MVRV Ratio has been under its 155-day MA for the same period as the bearish momentum in the Realized Profit/Loss, thus providing confluence to the signal.

BTC Price

Bitcoin had pushed towards $62,000 earlier in the week, but the asset has since slipped up as it’s now back at $57,800.

What's Your Reaction?

.gif)