Worldcoin Gains Upside Momentum: Is A Major Breakout Ahead?

Worldcoin (WLD) is showing signs of a strong upward push, gaining traction toward the $3.2 key resistance level. As market optimism builds, many are wondering whether Worldcoin is on the verge of a major breakout that could propel it to new highs or if current gains might face resistance in the near term. With growing momentum in its favor, this analysis explores the recent bullish momentum behind WLD and assesses whether it has the potential to trigger a major breakout. By evaluating key resistance levels, technical indicators, and overall market sentiment, we seek to determine if this rally can push the token to new highs or if a reversal is on the horizon. Analyzing Recent Gains Of Worldcoin WLD is currently trading above the 4-hour 100-day Simple Moving Average (SMA), indicating a robust bullish trend. The recent breakout above the key $2.1 resistance level further strengthens its upward momentum, suggesting that buyers are actively pushing the price higher. Should WLD maintain its position above this key threshold, it could open the door for more gains, with the next target potentially set at the $3.2 resistance level in the near future. An analysis of the 4-hour Relative Strength Index (RSI) reveals renewed bullish potential, as the RSI has surged to 77% after dipping to 52%. A reading above 70% often signals that an asset is approaching overbought conditions, indicating that WLD could experience short-term consolidation or profit-taking. However, if the buying pressure persists, it could lead to further upward movement, driving the price toward higher resistance levels. Related Reading: No Ties To OpenAI: Worldcoin Drops 9% As Top Trader Issues Warning Furthermore, the daily chart shows that Worldcoin is experiencing considerable pressure on the upside, characterized by a series of bullish candlestick formations. This positive trend is underscored by the asset’s position above the critical $2.1 support level and the 100-day SMA. As WLD maintains this upward trajectory, it reinforces optimistic sentiment in the market, setting the stage for potential gains as it approaches higher resistance levels. Lastly, the RSI on the daily chart is currently positioned at 72%, well above the pivotal 50% threshold, which suggests that buying pressure significantly outweighs selling pressure in the market. Can WLD Maintain Its Uptrend, Or Will Bears Intervene? WLD is currently exhibiting strong, upbeat momentum as it approaches the $3.2 resistance level. A successful breakout above this mark could unlock additional gains, potentially driving the price toward the $5.2 resistance level. Related Reading: Worldcoin Drops 6% Amid Alameda Research 1.5 Million Token Sale, Will WLD Price Hold? Conversely, if bears take control at the $3.2 resistance level, the price may start to decline toward the $2.1 support range. A drop below this level could trigger a deeper decline, possibly leading to a test of the $1.2 support level and beyond. Featured image from LinkedIn, chart from Tradingview.com

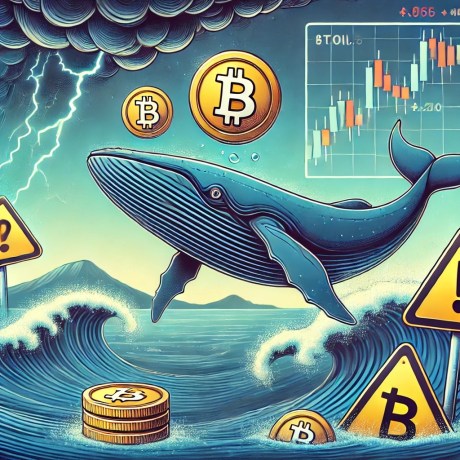

Worldcoin (WLD) is showing signs of a strong upward push, gaining traction toward the $3.2 key resistance level. As market optimism builds, many are wondering whether Worldcoin is on the verge of a major breakout that could propel it to new highs or if current gains might face resistance in the near term.

With growing momentum in its favor, this analysis explores the recent bullish momentum behind WLD and assesses whether it has the potential to trigger a major breakout. By evaluating key resistance levels, technical indicators, and overall market sentiment, we seek to determine if this rally can push the token to new highs or if a reversal is on the horizon.

Analyzing Recent Gains Of Worldcoin

WLD is currently trading above the 4-hour 100-day Simple Moving Average (SMA), indicating a robust bullish trend. The recent breakout above the key $2.1 resistance level further strengthens its upward momentum, suggesting that buyers are actively pushing the price higher. Should WLD maintain its position above this key threshold, it could open the door for more gains, with the next target potentially set at the $3.2 resistance level in the near future.

An analysis of the 4-hour Relative Strength Index (RSI) reveals renewed bullish potential, as the RSI has surged to 77% after dipping to 52%. A reading above 70% often signals that an asset is approaching overbought conditions, indicating that WLD could experience short-term consolidation or profit-taking. However, if the buying pressure persists, it could lead to further upward movement, driving the price toward higher resistance levels.

Furthermore, the daily chart shows that Worldcoin is experiencing considerable pressure on the upside, characterized by a series of bullish candlestick formations. This positive trend is underscored by the asset’s position above the critical $2.1 support level and the 100-day SMA. As WLD maintains this upward trajectory, it reinforces optimistic sentiment in the market, setting the stage for potential gains as it approaches higher resistance levels.

Lastly, the RSI on the daily chart is currently positioned at 72%, well above the pivotal 50% threshold, which suggests that buying pressure significantly outweighs selling pressure in the market.

Can WLD Maintain Its Uptrend, Or Will Bears Intervene?

WLD is currently exhibiting strong, upbeat momentum as it approaches the $3.2 resistance level. A successful breakout above this mark could unlock additional gains, potentially driving the price toward the $5.2 resistance level.

Conversely, if bears take control at the $3.2 resistance level, the price may start to decline toward the $2.1 support range. A drop below this level could trigger a deeper decline, possibly leading to a test of the $1.2 support level and beyond.

What's Your Reaction?

.gif)