AVAX Poised For 2025 Surge: Analyst Predicts $382 All-Time High

Cryptocurrency enthusiasts are ecstatic after AVAX mapped out the first signs of a probable breakout, and a famous crypto analyst fueled the wave of optimism with his bullish forecast. The expert, Alan Santana, believes that AVAX graphs look pretty much alike compared to Bitcoin before it surged in price. Now, can AVAX be about to replay this scenario? An in-depth analysis and further explanation are provided here. Related Reading: Dogecoin Major Metrics Fire Bullish Signals, Can Price Cross $0.5 Drawing Parallels With Bitcoin Santana’s analysis hinged on the idea that Avalanche’s elongated consolidation phase throughout 2022 and 2023 is quite in resemblance with those phases in Bitcoin’s history. He had, in particular, mentioned that the plunge of Bitcoin from $70,000 to $49,000 was followed by a 4.5-month consolidation phase before the cryptocurrency began to recover. Similarly, Bitcoin’s resurgence above $20,000 in 2023 came after a seven-month accumulation period. ✴️ Avalanche Pre-2025 Bull-Market Accumulation Zone & Strategy By now, you already know the theme… Accumulation before bullish-wave. Bullish wave to end in a bullish-run. Avalanche vs Bitcoin: An Analogy The accumulation phase can be seen as the training phase, the… pic.twitter.com/bEsEAD1QJk — Alan Santana (@lamatrades1111) August 10, 2024 Santana believes these historical cases prove that AVAX might be gearing for a mammoth bull market as far ahead as 2025. According to him, this moderate wave of bullishness seen towards the tail end of 2023 and early 2024 is just a minor phase within the grand plan of the bigger market structure. It is an era of correction that has to happen, according to Santana, which would then give way to another accumulation period and is supposed to be paving the way for a substantial bullish breakout. New All-Time Highs Ahead? Santana believes AVAX could reach a new ATH of $382. He based his projection on the extension of Fibonacci levels from the low of the bear market to the previous ATH. According to Santana, two key levels in this analysis are 1.618 and 2.618, with respective price targets of $232 and $370 respectively. Under the assumption that everything unfolds as predicted, then, in this case, AVAX will become among the best performing cryptocurrencies within the next few years. While these figures may look optimistic, they are in direct adherence to the trend seen in other popular cryptocurrencies. As Santana points out, long-term predictions such as this should be taken very cautiously, but he exudes full confidence in AVAX. AVAX: The Case For A ‘Buy And Hold’ Strategy Santana was advising a “buy and hold” approach for investors. He advised against perfect timing of the market, lest one is not investing at all while waiting for a possible price dip. Instead, Santana suggested establishing a price range within which AVAX could be gradually accumulated, especially below $20, and then just holding the tokens for the long term until the market turns bullish. Related Reading: Bitcoin Death Cross Threatens To Trigger Crash If Price Does Not Hold $62,000 Market Sentiment & Technical Indicators Although the market sentiment at the moment would turn out to be more neutral, as reflected by a Fear & Greed Index score of 45, there are some rays of optimism. According to CoinCodex, the price prediction backing the strong bull run states that AVAX might rise to a value as high as $72.68, up by 230.17%, as soon as September 2024. If one had to view the recent performance of the asset, with its average volatility and changes of 12.42% over the past month, it would give the feeling that AVAX is trading cheap. On the other hand, considering that the Fear & Greed Index is relatively low, it underprices the potential of AVAX within the market correspondingly, making it an excellent opportunity for buying before a probable rally. Featured image from Pexels, chart from TradingView

Cryptocurrency enthusiasts are ecstatic after AVAX mapped out the first signs of a probable breakout, and a famous crypto analyst fueled the wave of optimism with his bullish forecast. The expert, Alan Santana, believes that AVAX graphs look pretty much alike compared to Bitcoin before it surged in price. Now, can AVAX be about to replay this scenario? An in-depth analysis and further explanation are provided here.

Drawing Parallels With Bitcoin

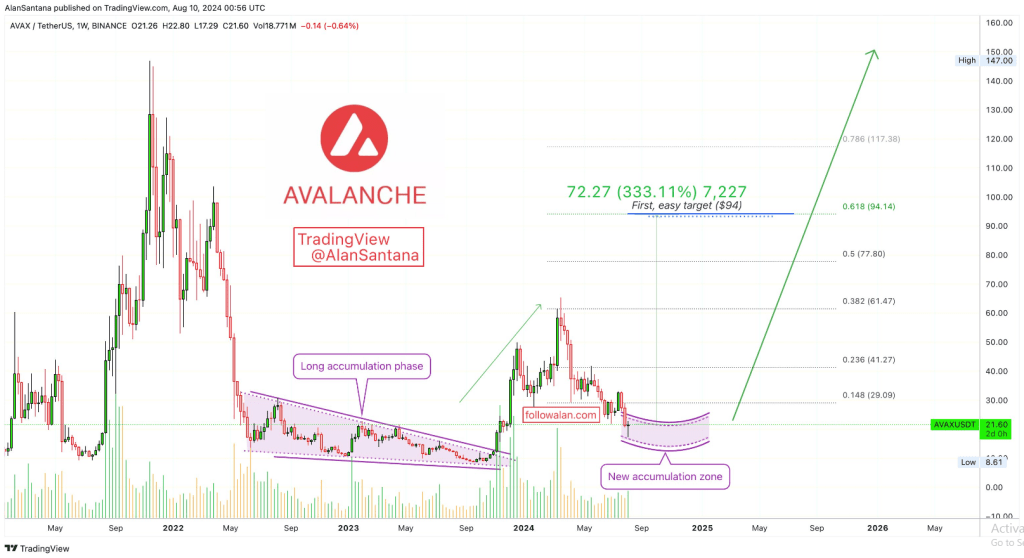

Santana’s analysis hinged on the idea that Avalanche’s elongated consolidation phase throughout 2022 and 2023 is quite in resemblance with those phases in Bitcoin’s history. He had, in particular, mentioned that the plunge of Bitcoin from $70,000 to $49,000 was followed by a 4.5-month consolidation phase before the cryptocurrency began to recover. Similarly, Bitcoin’s resurgence above $20,000 in 2023 came after a seven-month accumulation period.

Avalanche Pre-2025 Bull-Market Accumulation Zone & Strategy

By now, you already know the theme… Accumulation before bullish-wave. Bullish wave to end in a bullish-run.

Avalanche vs Bitcoin: An Analogy

The accumulation phase can be seen as the training phase, the… pic.twitter.com/bEsEAD1QJk

— Alan Santana (@lamatrades1111) August 10, 2024

Santana believes these historical cases prove that AVAX might be gearing for a mammoth bull market as far ahead as 2025. According to him, this moderate wave of bullishness seen towards the tail end of 2023 and early 2024 is just a minor phase within the grand plan of the bigger market structure.

It is an era of correction that has to happen, according to Santana, which would then give way to another accumulation period and is supposed to be paving the way for a substantial bullish breakout.

New All-Time Highs Ahead?

Santana believes AVAX could reach a new ATH of $382. He based his projection on the extension of Fibonacci levels from the low of the bear market to the previous ATH. According to Santana, two key levels in this analysis are 1.618 and 2.618, with respective price targets of $232 and $370 respectively.

Under the assumption that everything unfolds as predicted, then, in this case, AVAX will become among the best performing cryptocurrencies within the next few years.

While these figures may look optimistic, they are in direct adherence to the trend seen in other popular cryptocurrencies. As Santana points out, long-term predictions such as this should be taken very cautiously, but he exudes full confidence in AVAX.

AVAX: The Case For A ‘Buy And Hold’ Strategy

Santana was advising a “buy and hold” approach for investors. He advised against perfect timing of the market, lest one is not investing at all while waiting for a possible price dip. Instead, Santana suggested establishing a price range within which AVAX could be gradually accumulated, especially below $20, and then just holding the tokens for the long term until the market turns bullish.

Market Sentiment & Technical Indicators

Market Sentiment & Technical Indicators

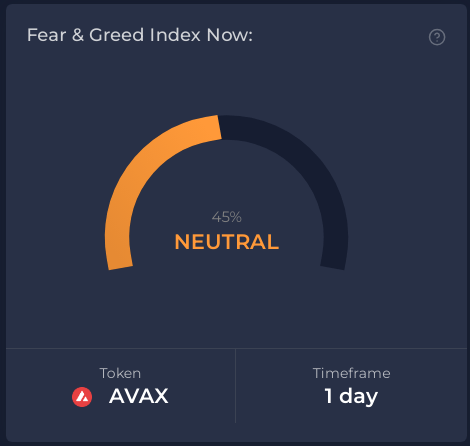

Although the market sentiment at the moment would turn out to be more neutral, as reflected by a Fear & Greed Index score of 45, there are some rays of optimism. According to CoinCodex, the price prediction backing the strong bull run states that AVAX might rise to a value as high as $72.68, up by 230.17%, as soon as September 2024.

If one had to view the recent performance of the asset, with its average volatility and changes of 12.42% over the past month, it would give the feeling that AVAX is trading cheap. On the other hand, considering that the Fear & Greed Index is relatively low, it underprices the potential of AVAX within the market correspondingly, making it an excellent opportunity for buying before a probable rally.

Featured image from Pexels, chart from TradingView

What's Your Reaction?

.gif)