Bitcoin Exchange Outflows Soar To Yearly High – Could This Fuel A Return To $70,000?

The recent slide in price of Bitcoin below the $60,000 threshold, followed by a subsequent drop below $50,000, might finally be showing signs of reversal, as suggested by the latest buying trends. These trends indicate a strong accumulation phase among large-scale investors, commonly known as whales, who have been capitalizing on the price dip to bolster their crypto holdings. Related Reading: Dogecoin Major Metrics Fire Bullish Signals, Can Price Cross $0.5 As such, Bitcoin addresses have collectively withdrawn over $1.7 billion worth of Bitcoin from various exchanges, marking the largest weekly outflow in more than a year. Accumulation Trend Amongst Bitcoin Holders According to on-chain data from IntoTheBlock, Bitcoin addresses have been steadily accumulating the coin in the past week. This data is highlighted through the analytic platform’s netflow data, which is crucial in forecasting an upcoming price uptick or downtrend for cryptocurrencies. The data highlights a significant shift, showing that outflows from exchanges have substantially outpaced inflows, with a staggering $1.7 billion more worth of BTC being withdrawn from exchanges than deposited. BTC recorded a whopping $1.7B net outflows from exchanges in the past week, the largest amount in over one year. This points to large whales accumulating through the recent downturn pic.twitter.com/m4INbZmKmB — IntoTheBlock (@intotheblock) August 9, 2024 Such outflow is typically interpreted as a sign that investors are choosing to hold onto their Bitcoin for the long term, which in turn reduces the amount of BTC available for sale on exchanges. What Does This Mean For Price? Recent dynamics in the wider world of investments and increased volatility saw Bitcoin falling below $50,000 again last week. Interestingly, this drastic price drop marked the first time Bitcoin traded below $50,000 in six months. However, be that as it may, the price decline gave many crypto believers a chance to accumulate more BTC at a six-month low. This created buying pressure among some traders, which in turn helped to prop up the price of BTC and helped to prevent further declines. A reduction in Bitcoin available on exchanges can have significant implications for the market. With fewer coins available for sale, buying pressure may increase, potentially driving up prices as demand remains steady or grows. At the time of writing, Bitcoin is trading at $60,989, having established support at $60,000. Considering the prevailing bullish sentiment, this buying pressure may as well be the momentum that pushes the Bitcoin price to the challenging $70,000 price level. However, the journey to $70,000 presents four different resistance levels at $63,730, $65,510, $67,350, and $69,150. The buying pressure continues to linger on according to the total flow to and from exchanges. The total flow data shows a negative 61.9% and 12.27% in the past 24 hours and seven-day timeframes, respectively. Related Reading: Bitcoin Penetrating Mainstream Macro Capital Markets – What About Ethereum? However, Bitcoin is not out of the woods yet, as the exchange on-chain market depth shows there are still more sellers than buyers. At the time of writing, sellers have placed sell orders of 31,458 BTC at an average price of $61,267 on various crypto exchanges. Meanwhile, buyers have placed buy orders for only 27,734 BTC at an average price of $61,263. Featured image from Pexels, chart from TradingView

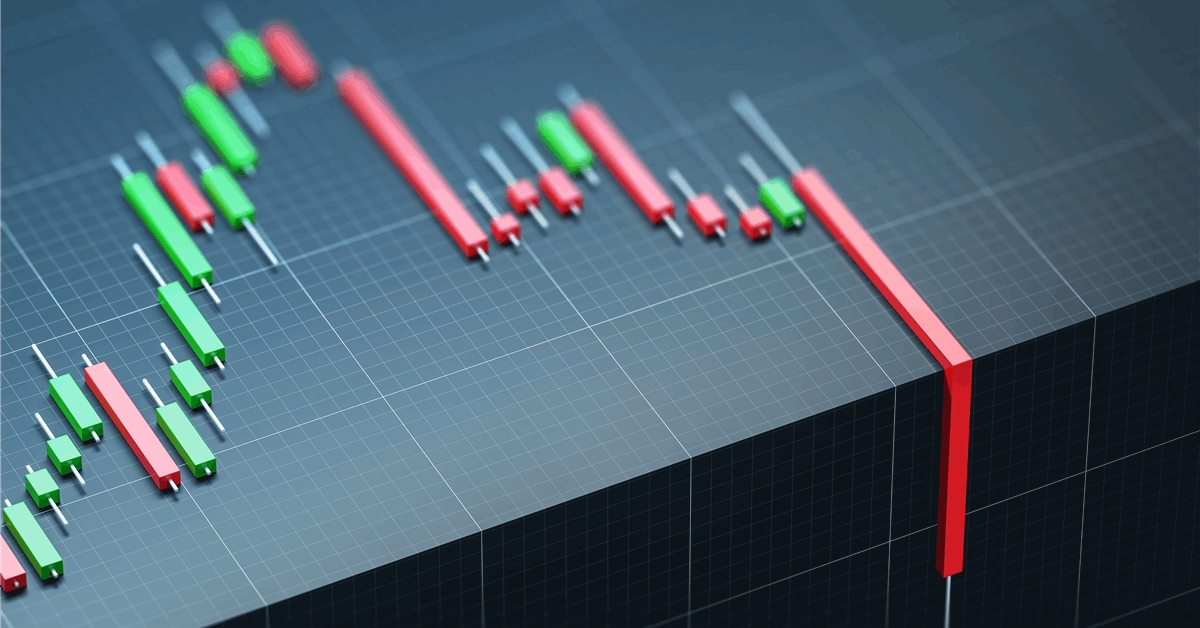

The recent slide in price of Bitcoin below the $60,000 threshold, followed by a subsequent drop below $50,000, might finally be showing signs of reversal, as suggested by the latest buying trends. These trends indicate a strong accumulation phase among large-scale investors, commonly known as whales, who have been capitalizing on the price dip to bolster their crypto holdings.

As such, Bitcoin addresses have collectively withdrawn over $1.7 billion worth of Bitcoin from various exchanges, marking the largest weekly outflow in more than a year.

Accumulation Trend Amongst Bitcoin Holders

According to on-chain data from IntoTheBlock, Bitcoin addresses have been steadily accumulating the coin in the past week. This data is highlighted through the analytic platform’s netflow data, which is crucial in forecasting an upcoming price uptick or downtrend for cryptocurrencies. The data highlights a significant shift, showing that outflows from exchanges have substantially outpaced inflows, with a staggering $1.7 billion more worth of BTC being withdrawn from exchanges than deposited.

BTC recorded a whopping $1.7B net outflows from exchanges in the past week, the largest amount in over one year.

This points to large whales accumulating through the recent downturn pic.twitter.com/m4INbZmKmB

— IntoTheBlock (@intotheblock) August 9, 2024

Such outflow is typically interpreted as a sign that investors are choosing to hold onto their Bitcoin for the long term, which in turn reduces the amount of BTC available for sale on exchanges.

What Does This Mean For Price?

Recent dynamics in the wider world of investments and increased volatility saw Bitcoin falling below $50,000 again last week. Interestingly, this drastic price drop marked the first time Bitcoin traded below $50,000 in six months. However, be that as it may, the price decline gave many crypto believers a chance to accumulate more BTC at a six-month low. This created buying pressure among some traders, which in turn helped to prop up the price of BTC and helped to prevent further declines.

A reduction in Bitcoin available on exchanges can have significant implications for the market. With fewer coins available for sale, buying pressure may increase, potentially driving up prices as demand remains steady or grows. At the time of writing, Bitcoin is trading at $60,989, having established support at $60,000.

Considering the prevailing bullish sentiment, this buying pressure may as well be the momentum that pushes the Bitcoin price to the challenging $70,000 price level. However, the journey to $70,000 presents four different resistance levels at $63,730, $65,510, $67,350, and $69,150.

The buying pressure continues to linger on according to the total flow to and from exchanges. The total flow data shows a negative 61.9% and 12.27% in the past 24 hours and seven-day timeframes, respectively.

However, Bitcoin is not out of the woods yet, as the exchange on-chain market depth shows there are still more sellers than buyers. At the time of writing, sellers have placed sell orders of 31,458 BTC at an average price of $61,267 on various crypto exchanges. Meanwhile, buyers have placed buy orders for only 27,734 BTC at an average price of $61,263.

Featured image from Pexels, chart from TradingView

What's Your Reaction?

.gif)