Solana (SOL) Hints at Downside Correction: Can It Hold Key Support?

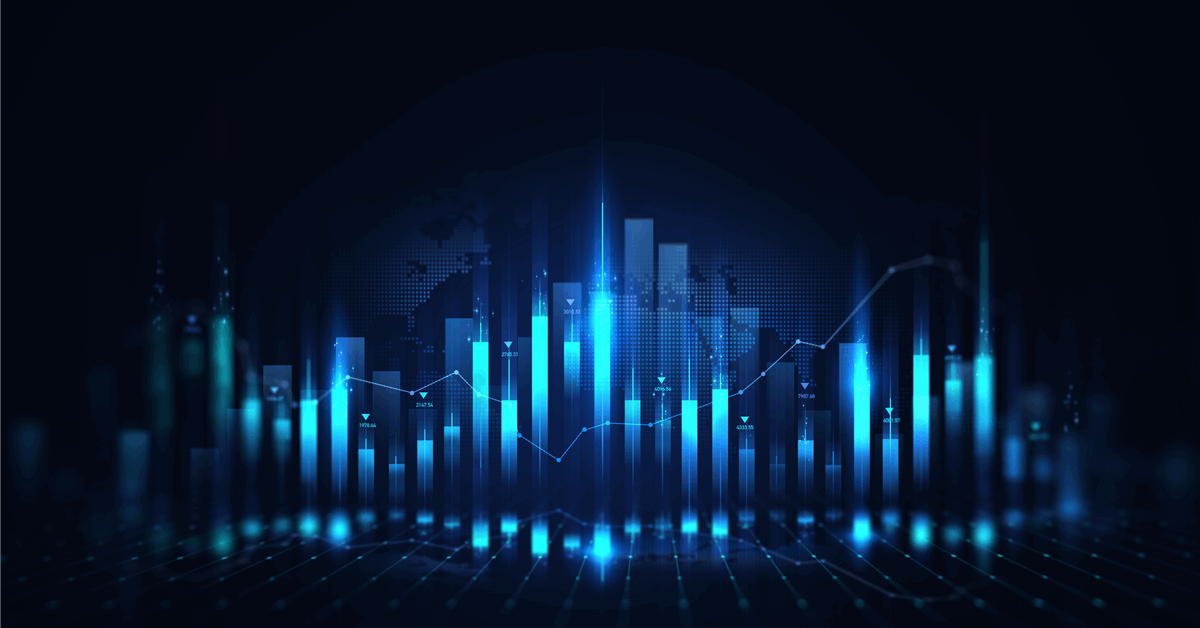

Solana struggled to clear the $172 resistance zone. SOL price is correcting gains and might soon test the $162 support zone. SOL price is correcting gains from the $172 resistance zone against the US Dollar. The price is now trading above $162 and the 100-hourly simple moving average. There was a break below a connecting bullish trend line with support at $166 on the hourly chart of the SOL/USD pair (data source from Kraken). The pair could revisit the $162 support zone before the bulls take a stand. Solana Price Eyes Retest of Support Solana price climbed above the $150 and $155 levels. SOL gained pace after there was a close above the $162 resistance level. However, the bears were active near the $172 zone. The price started a downside correction from the $171 high like Bitcoin and Ethereum. There was a move below the $168 level. The price declined below the 50% Fib retracement level of the upward move from the $161.23 swing low to the $171.00 high. Besides, there was a break below a connecting bullish trend line with support at $166 on the hourly chart of the SOL/USD pair. Solana is now trading above $162 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $168 level. The next major resistance is near the $170 level. The main resistance could be $172. A successful close above the $170 and $172 resistance levels could set the pace for another steady increase. The next key resistance is $180. Any more gains might send the price toward the $188 level. More Losses in SOL? If SOL fails to rise above the $170 resistance, it could start another decline. Initial support on the downside is near the $164 level or the 76.4% Fib retracement level of the upward move from the $161.23 swing low to the $171.00 high. The first major support is near the $162 level. A break below the $162 level might send the price toward the $155 zone. If there is a close below the $155 support, the price could decline toward the $150 support in the near term. Technical Indicators Hourly MACD – The MACD for SOL/USD is gaining pace in the bearish zone. Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level. Major Support Levels – $164 and $162. Major Resistance Levels – $168 and $172.

Solana struggled to clear the $172 resistance zone. SOL price is correcting gains and might soon test the $162 support zone.

- SOL price is correcting gains from the $172 resistance zone against the US Dollar.

- The price is now trading above $162 and the 100-hourly simple moving average.

- There was a break below a connecting bullish trend line with support at $166 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could revisit the $162 support zone before the bulls take a stand.

Solana Price Eyes Retest of Support

Solana price climbed above the $150 and $155 levels. SOL gained pace after there was a close above the $162 resistance level. However, the bears were active near the $172 zone.

The price started a downside correction from the $171 high like Bitcoin and Ethereum. There was a move below the $168 level. The price declined below the 50% Fib retracement level of the upward move from the $161.23 swing low to the $171.00 high.

Besides, there was a break below a connecting bullish trend line with support at $166 on the hourly chart of the SOL/USD pair. Solana is now trading above $162 and the 100-hourly simple moving average.

On the upside, the price is facing resistance near the $168 level. The next major resistance is near the $170 level. The main resistance could be $172. A successful close above the $170 and $172 resistance levels could set the pace for another steady increase. The next key resistance is $180. Any more gains might send the price toward the $188 level.

More Losses in SOL?

If SOL fails to rise above the $170 resistance, it could start another decline. Initial support on the downside is near the $164 level or the 76.4% Fib retracement level of the upward move from the $161.23 swing low to the $171.00 high.

The first major support is near the $162 level. A break below the $162 level might send the price toward the $155 zone. If there is a close below the $155 support, the price could decline toward the $150 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $164 and $162.

Major Resistance Levels – $168 and $172.

What's Your Reaction?

.jpg)

.gif)